A budget is really just about telling your money where to go, instead of scratching your head at the end of the month wondering where it all went. The whole process boils down to four key moves: figuring out your total income, keeping an eye on your expenses, picking a budgeting style that actually works for you, and tweaking your plan as you go. It's a surprisingly simple formula for taking back control.

Why a Budget Is Your Ticket to Financial Freedom

Let's be real—the word "budget" can sound super restrictive. Especially when you're a student juggling classes, a social life, and maybe a part-time job on the side. But what if a budget was actually a tool for more freedom? Instead of seeing it as a set of rules holding you back, think of it as a roadmap that guides you toward the things you really want.

It’s all about making conscious choices with your cash. A good budget is what helps you afford that spring break trip without stress, cover your textbooks easily, or just enjoy those late-night pizza runs guilt-free because you actually planned for them.

A budget isn't about limiting yourself—it's about giving yourself permission to spend on the things that truly matter to you.

Gaining Control in a World of Financial Pressures

Being a student comes with its own unique money pressures. You've got tuition fees, pricey textbooks, and the constant temptation of going out with mates. It's easy to feel totally overwhelmed. In fact, a huge number of students feel financial stress, which can seriously mess with your grades and mental health. Having a simple plan for your money helps you navigate all that with a bit more confidence.

By learning how to create a monthly budget now, you’re building healthy money habits that will stick with you long after you graduate. You'll get clarity on your spending and feel way more secure knowing you have a plan.

This guide will break the whole thing down into manageable chunks. Before we dive into the details, here's a quick look at the core stages we'll cover. Think of this as your game plan for getting in the driver's seat of your finances.

The Four Core Steps to Creating Your First Budget

| Step | What It Involves | Why It's Important |

|---|---|---|

| Calculate Income | Adding up all sources of money coming in each month. | This gives you a realistic baseline so you know what you have to work with. |

| Track Expenses | Recording every single purchase, from rent to that morning coffee. | It pulls back the curtain on where your money is actually going. |

| Set & Balance | Allocating your funds to different categories and making it all add up. | This step ensures your spending lines up with your income and your goals. |

| Review & Adjust | Checking in on your budget regularly to make necessary changes. | It keeps your budget relevant and effective as your life and priorities change. |

Nailing these four areas is the foundation of a budget that doesn't just work on paper but works for you in the real world.

Figuring Out Your True Monthly Income

Before you can even think about spending, you’ve got to get a crystal-clear picture of what's actually coming in. This is ground zero for your budget. For students, this number can be all over the place – it’s rarely a simple, predictable paycheck.

Your income might be a messy-but-awesome mix of wages from a cafe job, cash from a freelance gig, help from your parents, and scholarship funds. Nailing down a reliable figure is the first big challenge.

First things first, grab a notebook or open a spreadsheet and list every single source of money you get. Don’t leave anything out, no matter how small or random it seems. Think bigger than just your main job.

Your income streams might look something like this:

- Part-Time Job: Your net pay (what you actually get after tax) from your regular employment.

- Freelance or Gig Work: Money from side hustles like tutoring, food delivery, or maybe selling your art online.

- Parental Support: Any regular allowance or contributions from your family.

- Scholarships & Grants: Funds from financial aid that you can use for living expenses (make sure you check the terms!).

- Other Income: Birthday cash, money from selling old textbooks, that random refund you forgot about. It all counts.

Once you have everything listed out, it's time to deal with the inevitable ups and downs. A student's income rarely stays the same from one month to the next.

Taming Your Inconsistent Income

If your earnings jump around, trying to budget based on a really good month is a recipe for disaster. It’s like planning a party before the guests have even RSVP'd. Instead, you need to find a realistic baseline you can actually count on.

There are a couple of great ways to do this.

A popular method is to calculate your average income over the last three months. Just add up what you earned in the last three months and divide by three. This helps smooth out the peaks and valleys, giving you a more dependable number to plug into your budget.

Pro Tip: Want an even safer approach? Base your budget on your lowest-earning month from the past three to six months. This creates a built-in financial buffer. Any money you earn above that baseline is a bonus you can throw directly at savings or debt.

Let's say you earned $900, $1,200, and $750 over the last three months. Your average would be $950. But a super-safe, conservative budget would use the $750 figure. This stops you from committing to expenses you can’t cover when your hours get cut or a freelance client pays late.

It also doesn't hurt to keep an eye on the bigger economic picture. Global trends can affect job availability and pay for students. Some financial experts suggest students should only plan for a modest income increase of 2-3% per year. This keeps your budget flexible and stops you from banking on money you don't have yet. You can read more about global economic projections and what they mean for personal finance if you want to dive deeper.

By taking the time to calculate a reliable income figure, you're laying a rock-solid foundation for your entire budget. You'll avoid the classic mistake of overspending based on wishful thinking, which is a major source of money stress.

Finding Where Your Money Really Goes

Ever get to the end of the month, check your bank account, and have that sinking feeling of, "Wait… where did it all go?" You're definitely not alone. This is the detective phase of budgeting, where you grab a magnifying glass and figure out exactly where every pound and penny is disappearing to.

The first move is to just track what you're spending. This isn't about feeling guilty over that third coffee of the day; it's about gathering cold, hard data. Once you know what's coming in, you have to pinpoint what's going out. For a detailed guide on this crucial first step, check out this great resource on how to effectively track your expenses.

You can use your banking app, a dedicated budgeting tool, or even just an old-school notebook. The key is to record everything for at least one full month to get an honest baseline.

Sorting Your Spending Into Buckets

To actually make sense of all this information, you need to group your expenses into categories. This is how you'll spot patterns and see where you might be accidentally overspending. Generally, everything you spend falls into two main buckets.

Fixed Costs

These are the predictable, non-negotiable bills that pop up around the same time every month. No surprises here.

- Rent or Accommodation: This is almost always your biggest fixed cost, whether you’re in halls or a shared house. Finding ways to chip away at this can be a total game-changer; our guide on student accommodation options has some solid ideas.

- Phone Bill: Usually the same amount every month, give or take.

- Subscriptions: All those services you've signed up for – Netflix, Spotify, the gym, you name it.

- Insurance: Things like renters or car insurance if you have them.

Variable Costs

Okay, this is where things get interesting. These expenses change from month to month, and it’s where you have the most power to make adjustments.

- Groceries: This can swing wildly depending on how much you meal prep (or don't).

- Transportation: Bus fares, petrol for your car, or the odd Uber ride.

- Entertainment: Nights out, cinema tickets, gigs, and society events.

- Personal Care: Haircuts, toiletries, and all those other essentials.

- Eating Out: This covers everything from coffees and lunches on campus to Friday night takeaways.

The minute you separate your fixed and variable costs, you instantly see what's locked in and where you have some wiggle room. It’s the key to making smart cuts without feeling like you're missing out on life.

Spotting Your Spending Leaks

After tracking for a month, you'll start to see them: the small, frequent purchases that quietly drain your account. We call these "spending leaks." For a student, a classic example is the daily $5 latte that ends up costing you $150 a month. Or maybe it's those frequent food delivery orders that cost way more than a home-cooked meal.

Identifying these leaks is a massive win. It’s not about cutting out all the fun stuff. It's about being more intentional. Maybe you decide to make coffee at home on weekdays and treat yourself on Fridays, or you limit takeaways to a once-a-week thing.

It's also smart to think about rising costs. Recent data shows that people expect their living expenses to go up by about two percent each year because of inflation. Overall spending is projected to rise by 2.3% in the next year, which means you should probably account for slightly higher costs when you're planning ahead. Building a small buffer for inflation into your budget stops it from becoming useless in a few months.

Getting this data gives you the power to build a budget that's actually realistic and that you can stick to.

Choosing a Budgeting Method That Actually Works for You

Alright, you've figured out what's coming in and what's going out. Now for the fun part: picking a system to actually manage it all.

There’s no magic "best" way to budget. Honestly, the right method is the one you’ll stick with when you’re tired, stressed, and tempted by that late-night Uber Eats order. Your personality and what you’re trying to achieve financially will really shape what feels like a useful tool versus a massive chore.

Let’s walk through three of the most popular methods and see which one clicks for you.

The 50/30/20 Rule For Balanced Simplicity

If you want a straightforward plan that doesn't involve tracking every single coffee, the 50/30/20 rule is a fantastic place to start. It’s less about obsessing over pennies and more about making sure your money is generally flowing in the right directions.

Here's the simple breakdown:

- 50% on Needs: This chunk covers the absolute essentials. Think rent, utilities, groceries, your bus pass to uni, and any minimum debt payments you have to make.

- 30% on Wants: This is your fun money! It’s for eating out, Netflix, new clothes, weekend trips, and basically anything that isn't a strict necessity.

- 20% on Savings & Debt: The last slice goes towards your future self. Use it to build an emergency fund, save for a big goal, or throw extra cash at student loans or a credit card.

This method is perfect if you just want some basic guardrails without getting lost in the weeds. It’s flexible and super easy to get started with. The downside? Its simplicity can be a trap. If you've got a mountain of debt or a really aggressive savings goal, you might find it’s just not structured enough to keep you on track.

Zero-Based Budgeting For Total Control

Are you the type of person who loves a detailed, colour-coded study plan? If so, Zero-Based Budgeting (ZBB) might be your perfect match. The whole idea is that your income minus your expenses equals zero. Every single dollar gets a job before the month even begins.

With ZBB, you're not just watching where your money went—you're telling it exactly where to go. That level of intention is a game-changer for cutting out mindless spending and hitting your goals way faster.

Say you bring in $1,200 this month. You'll literally assign all $1,200 to your different budget categories: $600 for rent, $200 for groceries, $100 for transport, $150 for savings… you get the picture. You keep going until there's nothing left unassigned.

This forces you to be incredibly mindful of every purchase. The biggest drawback is that it’s a commitment. ZBB requires you to be hands-on with your finances, which can feel like another assignment to deal with when you’re already swamped with coursework.

The Envelope System For Hands-On Spenders

This one is old-school, but it’s incredibly powerful if you find yourself overspending with a quick tap of your card. The Envelope System is a cash-based approach for your variable spending—categories like groceries, going out, and personal stuff.

You literally take the cash you’ve budgeted for each category and put it into separate, labelled envelopes. Once the "Eating Out" envelope is empty, that’s it. No more restaurant meals until next month. It’s a hard stop that a debit card just doesn't provide.

Seeing the cash physically disappear makes spending feel so much more real. Grabbing a great deal from our list of student entertainment discounts feels even better when you're paying with cash you specifically set aside for fun.

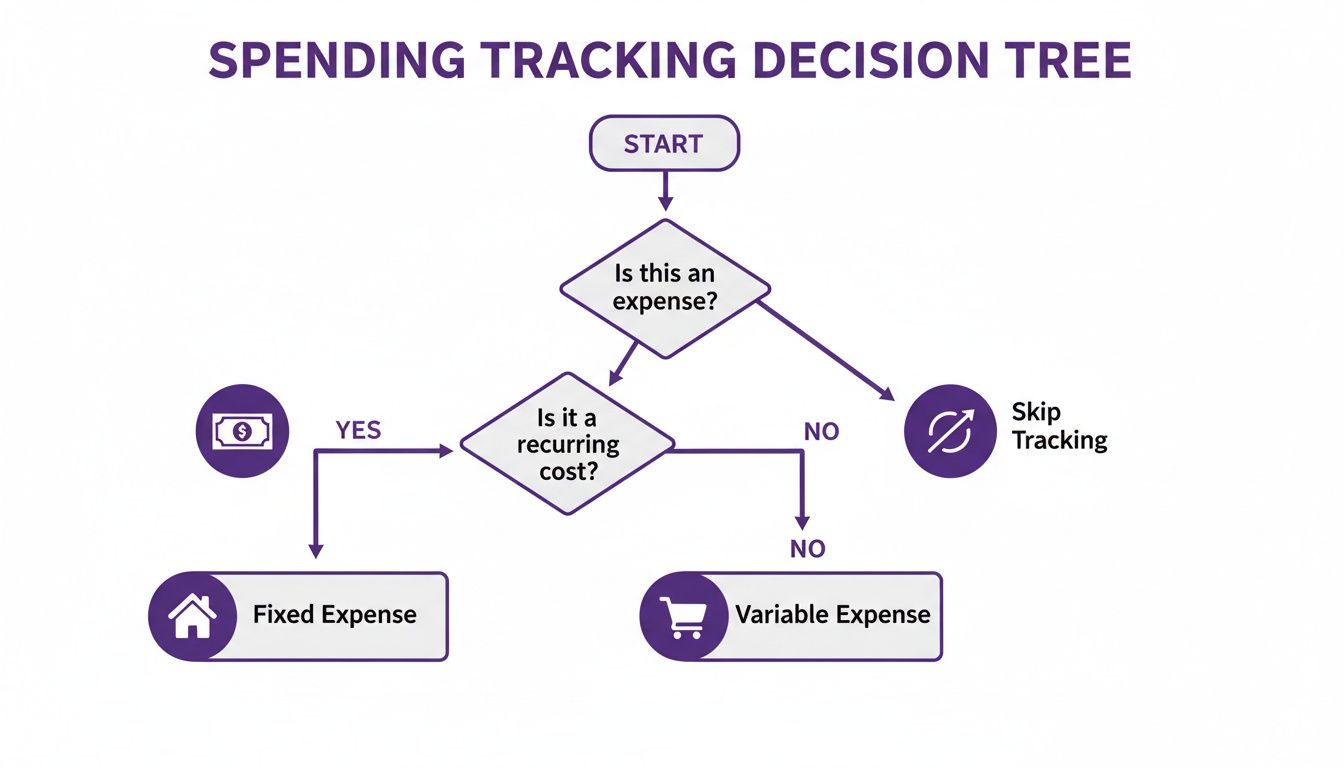

The flowchart below can help you start thinking about how to sort your costs, which is the first step for any of these methods.

This tree shows that basic mental process of identifying an expense and deciding if it’s a fixed cost or a variable one. Of course, the main challenge with the envelope system is the hassle of using cash for everything, especially for online shopping or paying bills. Plus, carrying a lot of cash around can feel a bit risky.

Which Budgeting Method Is Right for You?

Still on the fence? Choosing a method is a personal decision, and what works for your mate might not work for you. Here’s a quick comparison to help you find your best fit.

| Budgeting Method | Best For Students Who… | Potential Downside |

|---|---|---|

| 50/30/20 Rule | Want a simple, hands-off approach and broad guidelines rather than strict rules. | Not detailed enough for aggressive debt repayment or specific savings goals. |

| Zero-Based Budgeting | Love details, want total control over their money, and are trying to cut wasteful spending. | Can be very time-consuming and feel restrictive if you're not used to it. |

| The Envelope System | Are visual, hands-on learners and struggle with overspending on debit or credit cards. | Impractical for online purchases and bills; requires carrying cash. |

Ultimately, the goal is to find a system that makes you feel empowered, not stressed. Don't be afraid to try one out for a month and switch if it doesn’t feel right. The best budget is the one you can actually maintain.

Alright, you’ve tallied up your income and stared your spending habits straight in the face. Now comes the fun part: putting it all together and building your first proper budget. This is where you go from just watching your money to actively telling it where to go. It doesn't matter if you're a spreadsheet whiz or a pen-and-paper traditionalist; the goal is the same.

Grab the budgeting method you picked earlier and start plugging in your numbers. This means giving every single dollar a job, from non-negotiables like rent to the cash you set aside for your weekly grocery haul.

Creating the First Draft

First up, stick your total monthly income right at the top of the page. Next, immediately subtract your fixed costs—think rent, phone bill, subscriptions. These are the bills that don’t change, so get them out of the way. Whatever is left is your playground for everything else: variable spending, savings, and chipping away at any debt.

Now, use the spending data you tracked to fill in your variable categories. If you know you spent around $200 on groceries last month, that’s your starting benchmark. Do the same for transport, entertainment, and personal stuff until every dollar from your income has been assigned a role.

The Balancing Act: What to Do When It Doesn't Add Up

Don't panic if your first draft is a total mess. It’s completely normal—in fact, it’s almost expected—to find your planned expenses are way higher than your income. This isn't a sign of failure. Honestly, it's the most important part of the whole process. It's the moment you start making real, powerful choices about your money.

When your expenses are too high, your variable spending is the first place to look. This is the stuff you have direct control over.

Start with small, realistic cuts you can actually stick to:

- Eating Out: Can you knock your takeaways down from three times a week to just one? That simple change could easily save you over $100 a month.

- Groceries: Get into meal prepping or make the switch to store-brand products. You'd be surprised how much you can save without really noticing a difference.

- Entertainment: Make free campus events or society meetups your go-to instead of pricey nights out.

A budget shortfall isn't a dead end. It's a signpost pointing you toward areas where you can spend more intentionally and reclaim control of your finances.

Setting Goals and Tackling Debt

A budget is so much more than just a list of bills. It's your roadmap to building a better financial future. Two categories that absolutely have to be in your plan are savings and debt repayment. Even if you can only afford to put a tiny amount towards them, making them a priority is a massive win.

Your savings goals need to be specific and have a purpose. Forget vague ideas like "save money." Instead, create actual line items:

- Emergency Fund: Aim for $500 to start. This is your safety net for when your laptop dies or you get a surprise bill, so you don't have to rack up debt.

- New Laptop Fund: Need a new computer in a year? Divide its cost by 12, and that’s your monthly savings target. Easy.

- Spring Break Trip: Having a fun goal makes saving feel like an achievement, not a chore.

If you're dealing with credit card debt or student loans, list the minimum payments as a fixed cost. Then, if you have any cash left in your budget, throw it here. Paying even $20 extra each month can make a real dent in the total interest you’ll pay over time. This approach transforms your budget from a boring expense tracker into a powerful tool for smashing your goals.

Making Your Budget Stick for the Long Run

Alright, so you’ve created your first monthly budget. That’s a massive win, but the real challenge is making it a habit. A budget isn't something you create once and then shove in a drawer; think of it as a living, breathing tool that needs to evolve with you.

To make it actually stick, consistency is everything.

Start by pencilling in a quick, weekly check-in with yourself. Seriously, it only takes about 15 minutes. Just pull up your bank app and glance through your transactions to make sure your spending is on track with your plan. This simple habit stops those little "oops" moments from turning into a full-blown budget disaster by the end of the month.

The Monthly Budget Review

At the end of each month, carve out an hour for a proper sit-down. This is your chance to get real about what worked, what was a total fail, and where you need to make some changes.

Were you constantly going over on groceries but barely touched your entertainment fund? Don't beat yourself up. Just move the money around for next month. It’s that simple.

Your budget is supposed to support your life, not make you miserable. If one category is always stressing you out, it’s a sign your budget needs tweaking—not that you've failed.

This regular adjustment helps you dodge 'budget fatigue' – that awful feeling of being so restricted that you just want to give up and order a giant pizza. Being flexible keeps your plan realistic and actually useful for your real life.

Handling Real-Life Challenges

Let's be honest, life happens. A surprise car repair or an unexpected trip home can feel like it’s completely torpedoed your plan. But this is where your budget really proves its worth.

If you have an emergency fund, now's the time to dip into it. If not, take a hard look at your variable spending—things like eating out, subscriptions, or shopping—and see where you can pull back for a bit.

And remember to celebrate the small wins! Did you nail your grocery budget this week? Manage to tuck an extra $20 into savings? Give yourself a pat on the back. That little hit of positive reinforcement is what keeps you motivated.

To make your budget even more sustainable, look for ways to slash your biggest fixed costs. For example, finding cheap accommodation options can free up a huge chunk of cash each month. You can also make saving effortless by setting up automatic bank transfers or using tools like the Student Wow Deals app to snag discounts on daily expenses.

Got a few questions rattling around? Don't worry, that's totally normal. When you're first getting your head around budgeting, a few things are bound to pop up. Let's tackle some of the most common ones.

What's the Best Budgeting App for a Student?

Honestly, the "best" app is whichever one you'll actually use. It really comes down to what clicks with your personality. But if you’re looking for a place to start, a few crowd-pleasers come to mind:

- For the big picture: If you want to connect your bank accounts and get a bird's-eye view of where your money is going without a ton of effort, something like Mint is a great shout.

- For the hands-on budgeter: Decided the zero-based method is for you? YNAB (You Need A Budget) is the undisputed champ. It’s built to help you give every single dollar a job.

- For digital envelopes: If you love the idea of the envelope system but don't want to carry cash, an app like Goodbudget is the perfect digital translation.

My best advice? Give the free versions of a couple of them a whirl. See which one feels less like a chore and more like a tool you actually want to open.

How Much Should a Student Save Each Month?

There’s no magic number here, so don't stress trying to find one. How much you can save is completely tied to your income and essential costs. That said, a great rule of thumb to aim for is the 50/30/20 rule. The goal is to funnel 20% of your income into savings and knocking down debt.

If that 20% sounds like a pipe dream right now, take a deep breath. It's okay. The most important thing is just to start. Building the habit is way more powerful than the amount.

Seriously, even tucking away $25 or $50 a month gets the ball rolling. It proves to yourself that you can do it, and that momentum is priceless. When you're just starting, consistency beats quantity every single time.

Did your budget just get torpedoed by a surprise car repair or a bigger-than-expected textbook bill? It happens. This is exactly why having an emergency fund is a game-changer.

If you’ve got one, now’s the time to use it. If not, take a hard look at your flexible spending—things like nights out, takeaways, or your clothing budget—and see where you can pull back for the rest of the month. Once you’re in the clear, make building that safety net a top priority, even if you’re only adding a few dollars a week.

Ready to make your student life more affordable? Join Student Wow Deals for free access to hundreds of exclusive discounts on food, fashion, tech, and more. Start saving today! Find out more at https://studentwowdeals.com.