Diving into the world of credit as a student doesn't have to be complicated. It really boils down to a few smart, simple moves. You can get your foot in the door by becoming an authorized user on a parent's credit card, grabbing a student-specific card, or starting with a secured card.

The trick is to start small. Make every single payment on time, keep your balances low, and you'll start building a positive history before you even graduate.

Why Building Credit in College Matters

I get it—juggling lectures, deadlines, and a social life is already a lot. Thinking about your credit score probably feels like a problem for "future you." But trust me, starting now is one of the savviest financial moves you can make. A solid credit history is the bedrock of your financial future.

It’s what lenders, landlords, and sometimes even employers look at to see if you’re reliable. A good score isn't just some number; it unlocks real-world benefits that will make your post-grad life way easier. It’s the difference between snagging your first apartment on your own versus needing a co-signer. It determines the interest rate you'll land on a car loan, which could save you thousands over the years.

The Power of a Good FICO Score

Most lenders lean on the FICO score, which ranges from 300 to 850. As a student, you're probably what's called "credit invisible"—meaning you have no score at all. That’s actually a great place to start. You have a blank slate to build a killer record from scratch, aiming for that sweet "good" to "excellent" range (670 and up).

Here’s a quick rundown of what makes up your score:

- Payment History (35%): This is the big one. Simply paying your bills on time, every single time, is the most important thing you can do.

- Amounts Owed (30%): You'll also hear this called credit utilization. It’s the percentage of your available credit you're using. The golden rule? Keep it below 30%.

- Length of Credit History (15%): The longer you've responsibly managed credit, the better. Starting in college gives you a huge head start.

Even something small, like using a student credit card to buy your textbooks and paying it off right away, positively impacts all these areas. Speaking of textbooks, you can get some great tips on managing those costs in our guide on selling used textbooks.

Laying the Groundwork Your First Year

Often, the easiest way to start is the best way. One of the simplest and most effective strategies is becoming an authorized user on a parent or guardian's well-managed credit card. This move lets you "piggyback" on their good credit habits without having to open your own account just yet.

According to Experian, this strategy allows the primary cardholder’s positive payment history and low credit utilization to show up on your report, giving your score a nice boost. In fact, some studies have shown that nearly 30% of college students who became authorized users saw their scores jump by at least 20 points within a year. This works best when the main account has a long, spotless history of on-time payments.

Key Takeaway: The best part? You don't even need to use the card to reap the benefits. Just being listed on the account means the primary cardholder's great habits—like their long history and low balances—get reflected on your own credit report.

Three Core Strategies for Student Credit Building

To lay it all out, here’s a quick look at the three most common paths students take to kickstart their credit journey. Each one is a solid choice; it's all about finding what fits you best right now.

| Strategy | How It Works | Best For |

|---|---|---|

| Become an Authorized User | You're added to a trusted family member's credit card. Their payment history and low balance help build your score. | Students with no income or those who want a low-risk starting point with the help of family. |

| Get a Student Credit Card | An unsecured credit card with a low limit designed for students. Issuers consider your student status for approval. | Students with a part-time job or some form of verifiable income who are ready to manage their own account. |

| Open a Secured Credit Card | You provide a cash deposit (e.g., $200) that becomes your credit limit. It's a safe way for lenders to give you a chance. | Students without any income or those who have been denied for other cards and want a guaranteed way to start. |

Each path is a proven and effective way to get started. The most important thing you can do is pick one and get the ball rolling. Future you will be very grateful.

Choosing Your First Credit Building Tool

Alright, let's talk about picking your first tool to start building credit. This is a big step, and honestly, choosing the right one can make all the difference. It's not about grabbing the first shiny credit card offer you see; it's about finding a product that fits your life right now and sets you up for success down the road.

We’re going to look at the three best options for students: student credit cards, secured cards, and credit-builder loans. Each one is designed for a slightly different situation, and the biggest deciding factor usually comes down to one thing: whether or not you have a steady income.

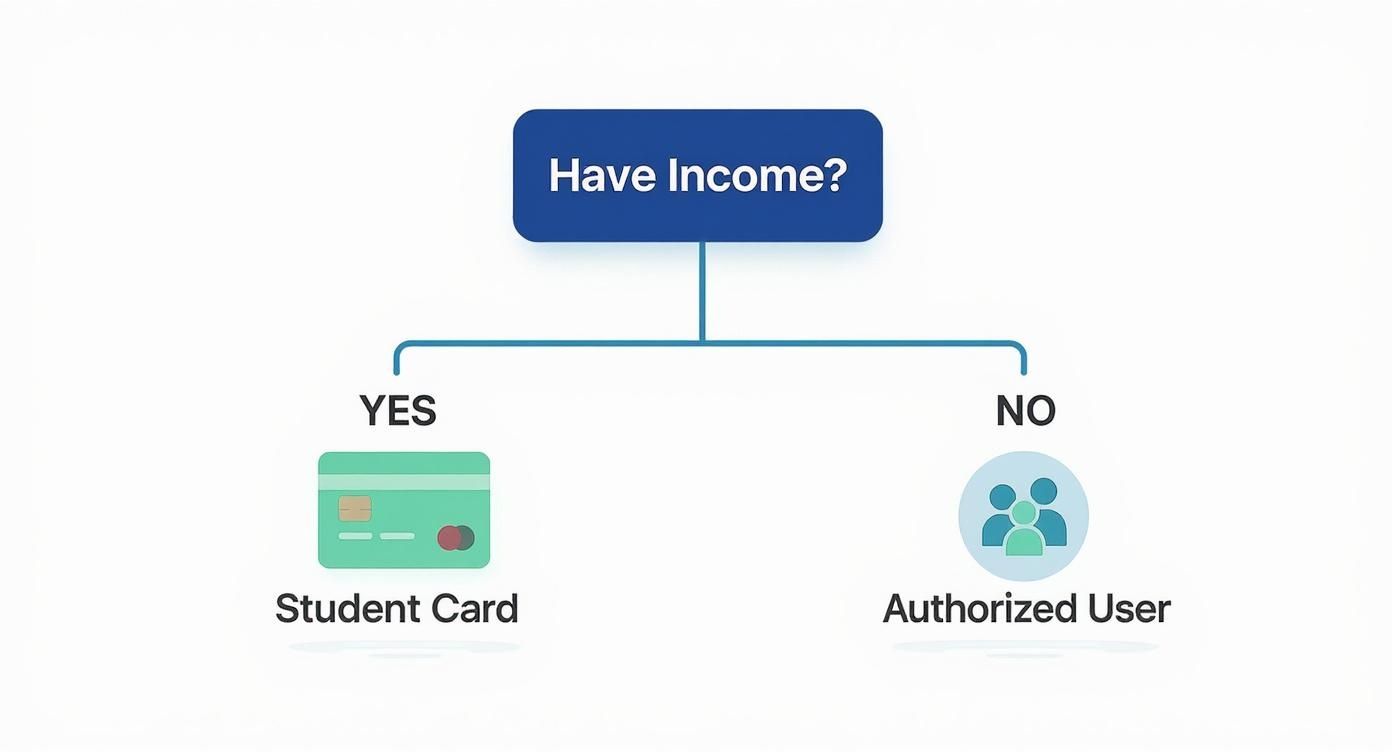

This little flowchart breaks it down nicely, showing you which path probably makes the most sense based on your job situation.

As you can see, having an income is the main fork in the road. It guides you toward a standard student card or points you to some other great (and safe) alternatives.

The Best Option for Students with Income

If you’ve got a part-time job, a paid internship, or any other kind of regular paycheck, a student credit card is probably your best starting point. These are "unsecured" cards, which just means you don’t have to put down a cash deposit to open one. Banks design these specifically for students who have a thin credit file but can prove they have money coming in.

Think of it this way: a card issuer sees your weekend cafe job as a sign you can handle a small line of credit. They'll likely start you off with a limit between $500 to $1,000—perfect for building a solid payment history on small, manageable purchases like your streaming services or weekly groceries.

A lot of student cards even throw in perks that are actually helpful for uni life:

- Cash back on things like food delivery or textbooks

- No annual fees, which is a huge money-saver

- Some even offer rewards for getting good grades

These cards are fantastic training wheels. You get real-world experience with billing cycles, interest, and payments without the risk of a massive credit limit tempting you.

Heads Up: When you apply, be upfront and honest about your income. Lenders need to see that you have a way to pay back what you borrow. Don't forget to include money from part-time jobs, scholarships, or even regular allowances if you get them.

Paths for Students Without Verifiable Income

No job? No worries. You've still got some brilliant options designed for exactly this scenario. In fact, trying to get a regular credit card without an income can lead to a rejection, which can put a small, temporary dent in your credit. It's much smarter to go with a tool built for this situation.

A secured credit card is one of the most powerful and accessible ways to build credit from zero. Here’s the deal: you give the bank a refundable security deposit, usually around $200, and that amount becomes your credit limit. This deposit basically eliminates the risk for the bank, which is why they are so much easier to get approved for.

You use it just like any other credit card—make a few small purchases, pay the bill on time every month, and you're golden. After about a year of responsible use, most banks will "graduate" you to a regular unsecured card and send your deposit back. It's a super safe and controlled way to prove you're creditworthy.

Another great option is a credit-builder loan. You'll find these at many credit unions and local banks. It's a bit different from a normal loan where you get cash upfront. Instead, the lender puts the loan amount (say, $500) into a locked savings account for you. You then make small monthly payments over a set period, like 6 or 12 months.

Every single on-time payment gets reported to the credit bureaus, building a positive track record. Once you've paid it all off, the account is unlocked and you get all your money back, sometimes with a little interest. It’s basically a forced savings plan that builds your credit score at the same time.

For international students who might not have a Social Security Number, it's also worth looking into how to get a credit card with an ITIN number as you figure out your best first step.

At the end of the day, picking the right tool is all about being realistic about where you're at financially. Match the product to your situation, and you'll be building a great credit foundation in no time.

Mastering Responsible Credit Card Habits

Getting your first credit card is a pretty big deal, but honestly, it's just the starting line. The real work of building a solid credit score happens with every tap, swipe, and monthly payment.

How you handle that little piece of plastic is what separates a strong financial future from a spiral of debt. This is where you build the financial habits that will stick with you for life.

Think of your credit score as your financial reputation. Lenders want to see a consistent, reliable pattern. The two golden rules for earning that trust are surprisingly simple: always pay your bill on time, and keep your balances low. Get these two things right, and you're well on your way.

The Golden Rule: Pay On Time, Every Time

Your payment history is the absolute heavyweight champion of your credit score. It makes up a massive 35% of the whole calculation.

Seriously, even one missed payment can haunt your credit report for up to seven years, acting as a red flag to anyone who looks you up. This is the single most important habit to lock down from day one.

Luckily, tech makes this pretty foolproof. The very first thing you should do after activating your card is set up automatic payments, or autopay. It’s a tiny action that acts as your ultimate safety net, ensuring you never miss a due date just because life got busy.

You have a couple of options here:

- Pay the full statement balance: This is the best-case scenario. It guarantees you pay off everything you owe each month, which means you avoid all interest charges. Plus, it shows lenders you only spend what you can actually afford to pay back.

- Pay the minimum amount: If you're worried about having enough cash in your account on the due date, setting autopay for the minimum is a solid backup plan. This ensures you’ll never be marked "late." You can (and should!) log in before the due date to pay off the rest.

Don’t just set it and forget it, though. Get into the habit of adding a calendar alert on your phone a few days before the payment is due. It’s a great second layer of defence and gives you total peace of mind.

Understand Credit Utilization

Right behind payment history is your credit utilization ratio, which accounts for 30% of your score. It sounds complicated, but it's not. It’s just the percentage of your available credit that you're currently using.

The universal advice from every expert is to keep this ratio below 30%.

Let’s put this into a real-world student scenario. Imagine your first student card has a $500 credit limit.

- Good Habit: You use it for your weekly groceries and your Netflix subscription, totalling about $100. Your utilization is $100 / $500 = 20%. Perfect. This shows you’re using credit responsibly without needing all of it.

- Bad Habit: You use it to buy a new laptop, maxing out the card at $500. Your utilization is $500 / $500 = 100%. This is a major warning sign to lenders that you might be financially stretched, and it can cause your score to drop.

A low credit utilization ratio tells lenders that you can manage credit wisely. Aiming for under 10% is even better for your score, but staying under that 30% mark is the essential target.

Building a great score is all about small, consistent actions. The best way to think about it is to treat your credit card like a debit card—only spend money you already have in the bank.

By paying your bill in full and on time, you can completely avoid interest fees. You’re essentially getting a free loan for a month while building a positive credit history. And remember, smart spending habits can be rewarded; check out the latest student discounts to make your money go even further.

Use Your Existing Bills to Boost Your Score

So far, we’ve been talking about credit-building tools that involve borrowing money, like credit cards. But what if you could build credit just by paying the bills you already have?

It’s a powerful, lower-risk strategy that’s perfect for students. You’re already paying for rent, your mobile phone, and probably a few streaming services. Traditionally, none of that good payment history would ever make it to your credit report. Now, some clever services are changing the game.

These programs work by linking to your bank account, spotting your regular bill payments, and reporting that positive history to the credit bureaus. For anyone with a thin credit file, this is massive. It adds more on-time payments to your record—a huge factor in your score.

How Rent and Utility Reporting Works

The most common way to do this is through rent reporting and special "boost" services. This is a no-brainer if you're living off-campus and paying rent each month. Turning that massive expense into a credit-building activity is one of the smartest financial moves you can make as a student.

Several services can help you do this; some are free, while others charge a small fee.

- Rent Reporting Services: These companies work with you or your landlord to verify your rent payments and report them. Since rent is often a student's biggest single expense, this can be incredibly effective.

- Credit "Boost" Programs: These are often free services offered by the credit bureaus themselves. They scan your bank account for a history of on-time payments for things like utilities, phone bills, and streaming subscriptions.

A great example is Experian Boost®, which lets you add these on-time payments directly to your Experian credit file. According to them, over 2 million users saw their credit scores go up by an average of 13 points. Even better, they report that 60% of students who used the service were able to get a credit score when they didn't have one before.

This whole strategy is about getting credit for the financial reliability you’re already showing. It’s a fantastic way to prove you're responsible without taking on any new debt.

Turn Your Student Accommodation into a Credit Builder

Picture this: you're renting a flat with friends. Every month, you reliably pay your share of the rent and utilities. Without a reporting service, those consistent payments are financially invisible. With one, each on-time payment becomes a positive mark on your credit report, helping build the very foundation of your score.

This is where your living situation becomes a powerful tool. For those still hunting for a place, check out our guide on finding the right student accommodation to get started.

Pro Tip: When looking at rent reporting services, check which credit bureaus they report to. Ideally, you want one that reports to all three heavy hitters (Experian, Equifax, and TransUnion) for the biggest impact.

Who Should Consider This Method?

Honestly, this is a good idea for almost any student, but it's a real game-changer for a few groups in particular.

- Students with Zero Credit History: If you're starting from scratch, this is one of the fastest and safest ways to become "credit visible" and generate your first score.

- Students Wary of Debt: If the idea of a credit card makes you a bit nervous, using your existing bills lets you build credit without the temptation to spend money you don't have.

- Those Needing a Small Score Bump: Already have a score but need a few extra points to qualify for something better? Adding your utility or rent payments can provide that quick lift.

Ultimately, this strategy rewards you for the responsible habits you already have. It’s an essential part of the modern toolkit for any student trying to build credit the smart way.

Common Credit Mistakes Students Make

Building a great credit score is definitely a marathon, not a sprint. While getting the good habits down is one half of the battle, knowing which mistakes to sidestep is just as critical. The road to good credit is littered with common pitfalls that are surprisingly easy to tumble into, especially when you're just starting out.

Think of it like navigating a new city without a map. A few wrong turns aren't the end of the world, but they can set you back and leave you feeling lost. Knowing the most common errors students make is like having a reliable GPS—it helps you avoid the dead ends and get where you're going a lot faster.

Let's break down the most frequent missteps and, more importantly, how you can steer clear of them.

Applying For Too Much Credit Too Soon

Once you turn 18, it can feel like a floodgate opens. Suddenly, you're getting pre-approved credit card offers in the mail and seeing ads pop up everywhere. It’s super tempting to apply for a few different ones just to see what you get approved for, especially if you're keen to get your credit history started.

Hold on, though. This is one of the biggest rookie mistakes you can make. Every time you formally apply for a credit card or loan, the lender pulls your credit report, which is called a hard inquiry. Each one can knock a few points off your score temporarily.

One or two isn't a huge deal, but a bunch of them in a short time frame screams "risk" to lenders. It can look like you're desperate for cash, which makes them pretty nervous about lending to you.

A Smarter Strategy: Do your homework first. Pick the one card that actually fits your student life (like one with no annual fee), and then apply for just that one. If you get it, give it at least six months before you even think about applying for another. This lets your score bounce back and gives you time to build a solid track record.

Maxing Out Your Credit Card

That first credit card with a $500 or $1,000 limit can feel a bit like free money. It’s way too easy to justify a big purchase—a new laptop, a weekend trip, festival tickets—by telling yourself you’ll pay it back down the line. But trust me, maxing out your card is a major red flag for your credit score.

This all comes back to your credit utilisation ratio, which is the second biggest piece of your credit score puzzle. Using all, or nearly all, of your available credit suggests you might be overstretched and relying on debt to get by. Even if you have every intention of paying it off, a huge balance reported at the end of the month can make your score take a nosedive.

A good rule of thumb? Treat your credit card like a debit card. If the money isn't in your bank account, don't charge it. This keeps your utilisation low and, best of all, saves you from getting stung by expensive interest.

Only Making The Minimum Payment

Making just the minimum payment is so tempting, especially when you're living on a tight student budget. It keeps your account in good standing and helps you dodge late fees, which is great. The problem is, it's a trap that can lock you into a long, expensive cycle of debt.

Credit card interest rates, or the Annual Percentage Rate (APR), are notoriously high. When you only pay the minimum, the rest of your balance starts racking up interest. The next month, you're paying interest on your original balance plus the interest from the month before. It’s called compounding interest, and it's how a small balance can snowball into a massive headache.

Just look at the maths:

- Scenario: You have a $1,000 balance on a card with a 20% APR.

- Minimum Payment: If you only pay the minimum (say, $25), it would take you over five years to clear it, and you'd pay hundreds of dollars in interest alone.

- Paying in Full: If you pay the full $1,000 off when the bill is due, you pay $0 in interest. Simple.

Even with the best intentions, it's possible to fall into credit card debt. If that happens, the key is to face it head-on. Check out these actionable tips for paying off credit card debt to get yourself back on solid ground. Your goal should always, always be to pay the full statement balance each month. No exceptions.

Student Credit FAQs: Your Top Questions Answered

Diving into the world of credit for the first time? It's totally normal to have a million questions. We've rounded up the ones we hear most from students and are breaking them down to give you the clear, straightforward answers you need to get started.

How Long Does It Take to Build a Good Credit Score?

You can get on the scoreboard faster than you might think. It usually takes about three to six months after opening your first credit account for a FICO score to be generated. Think of this as your starting point.

But getting to a "good" credit score—that's generally a score of 670 or higher—is more of a marathon than a sprint. For most students, hitting that milestone takes about one to two years of consistent, responsible credit use. That means paying every single bill on time, every time, and keeping your balances low. Patience is your best friend here.

Can I Build Credit Without a Credit Card?

Absolutely! While credit cards are a super common way to build credit, they’re definitely not the only game in town. There are plenty of other great ways to establish a positive payment history without ever swiping a traditional credit card.

Here are a few solid alternatives:

- Become an Authorized User: If a parent or guardian has a credit card they’ve managed well for years, they can add you as an authorized user. Their good habits and long history can give your credit report a serious boost.

- Try a Credit-Builder Loan: Many credit unions offer these. You make small, regular payments into a locked savings account, and those payments get reported to the credit bureaus. Once you've paid off the loan, the money is yours. It’s a brilliant way to prove you can handle payments.

- Report Your Bills: Services like Experian Boost® are game-changers. They let you get credit for the bills you're already paying, like rent, utilities, and even your Netflix subscription.

Our Take: These options are perfect if you're a bit wary of getting a credit card or haven't been approved for one yet. They let you build credit based on the financial responsibility you're already showing.

What's the Difference Between a Student Credit Card and a Secured Card?

Both are fantastic first steps, but they work in slightly different ways.

A student credit card is what’s known as an "unsecured" card, which means you don’t need to put down a deposit. They're specifically designed for uni students who have little to no credit history but can show some income (like from a part-time job).

A secured credit card, on the other hand, is your best bet if you have no income or have been turned down for other cards. You’ll make a small, refundable cash deposit—usually around $200—which then becomes your credit limit. Because your own money "secures" the credit line, it’s much less risky for the bank, making them way easier to get.

Should I Get Multiple Credit Cards as a Student?

Nope, definitely hold off on this for now. When you're just learning how to build credit as a student, your best move is to master one card first. Give yourself at least a year to get into the rhythm of paying on time and keeping your utilisation low.

Applying for a bunch of cards too quickly is a classic rookie mistake. Every time you apply, it triggers a "hard inquiry" on your credit report, which can knock your score down a few points. It’s much smarter to build a rock-solid foundation with one card before you even think about adding another.

Ready to make your student budget go further while building smart financial habits? Student Wow Deals offers exclusive discounts on everything from food to tech, helping you save money that you can put toward your financial goals. Find hundreds of free deals today at https://studentwowdeals.com.