Studying in another country is an incredible adventure, but let's be real—getting sick or injured is the last thing you want to worry about. That's where health insurance for international students comes in. It’s basically a specialized safety net designed to protect you from ridiculously high medical bills while you're away from home.

More often than not, it's a non-negotiable requirement for your student visa and university enrollment, making sure you can get medical help without it wrecking your finances.

Why Health Insurance Is Non-Negotiable for Studying Abroad

Getting ready to study abroad is a whirlwind of excitement. You’re sorting out visa paperwork, figuring out what to pack, and dreaming about all the new experiences ahead. But in that huge pre-departure checklist, getting solid health insurance is one of the most important boxes you'll tick. It's way more than just another piece of admin.

Think of your health insurance policy as your personal guide to a foreign healthcare system. If you catch a nasty flu or have an accident, you won't be left alone to figure out confusing medical bills or find a good doctor. Your insurance gives you a clear path to getting the care you need, right when you need it.

Your Financial Safety Net

In popular study destinations like the United States, there’s no universal healthcare system to fall back on. That means even a small medical issue can turn into a massive bill. A quick doctor's visit for what seems like a simple cold could set you back hundreds of dollars, and a trip to the emergency room for something like a sprained ankle? That could easily run into the thousands.

A good health insurance plan is your shield against these kinds of budget-busting costs. You pay a regular fee (called a premium), and in return, you get access to a network of doctors and hospitals at a tiny fraction of what you'd pay out-of-pocket. This financial protection is crucial so you can focus on your studies, not on the stress of unexpected debt.

A Mandatory Requirement for Your Journey

For most international students, health insurance isn’t a choice—it’s a strict requirement for both your student visa and your university. Governments and schools put these rules in place to make sure you're prepared for any health surprises. If you can't show proof of valid insurance, you could face serious problems, like having your visa cancelled.

If you're looking for a great place to start your research, this International Student Insurance: An Expat Medical Insurance Guide is a super helpful resource.

This isn't just a small-time requirement, either. The international student health insurance market was valued at around USD 5.85 billion in 2024 and is expected to keep growing. It's a big deal because protecting students is a top priority.

At the end of the day, having health insurance is all about peace of mind. It frees you up to dive into your classes and soak up the local culture, knowing you’re covered if something goes wrong. It’s a commitment to your own well-being, a theme you’ll see in our other resources, like these student discounts on health and fitness that help you stay well on a budget.

Getting to Grips with Visa and University Insurance Rules

Figuring out the insurance rules for studying abroad can feel like trying to solve a puzzle with pieces from ten different boxes. Every country, and sometimes every single university, has its own set of health insurance requirements for international students. Getting this right isn't just a friendly suggestion—it’s a dealbreaker, often tied directly to your visa approval and whether you can even enroll in your classes.

Think of it this way: these rules are the non-negotiable foundation of your entire study abroad adventure. Governments and schools put them in place to make sure you won't be left with a massive bill if you have an unexpected medical emergency. Messing this up can have serious consequences, like getting your visa application denied or being unenrolled from your course.

Why Your Visa Literally Depends on Your Insurance

For most countries, proving you have proper health coverage is a non-negotiable step in the visa application. They need to know you won’t become a financial strain on their public healthcare system if you get sick or have an accident. It's that simple.

Australia, for example, makes every international student get a specific policy called Overseas Student Health Cover (OSHC) for their entire stay. You have to show you've bought it before they’ll even think about granting your visa. If you're heading to Europe, you'll need to understand the Schengen Visa Insurance Requirements, which spell out the minimum coverage needed for medical emergencies and getting you home if necessary.

Your insurance policy is more than just a piece of paper; it’s proof that you’re financially responsible. It tells your host country that you’re prepared for whatever health challenges might come your way while you're focused on your studies.

To give you a clearer picture, insurance rules can vary quite a bit from one popular study destination to another.

Health Insurance Requirements in Top Study Destinations

Here's a quick rundown of what to typically expect in some of the most popular countries for international students.

| Country | Visa Requirement | University Policy | Typical System |

|---|---|---|---|

| USA | Often required, but varies by visa type. Proof of coverage is usually necessary. | Almost always mandatory. Universities have strict plans or waiver requirements. | Private insurance system; school-mandated plans are common. |

| UK | Required to pay the Immigration Health Surcharge (IHS) as part of the visa fee. | Not usually required, as the IHS grants access to the National Health Service (NHS). | Public system (NHS) funded by the mandatory IHS fee. |

| Canada | Varies by province. Some require public plan enrollment, others need private cover. | Universities enforce provincial rules and may offer supplemental private plans. | Mix of provincial public plans and private insurance options. |

| Australia | Mandatory. Must have Overseas Student Health Cover (OSHC) for the visa. | Enforced by the government visa condition. Universities guide you to OSHC providers. | Government-mandated private insurance (OSHC) for students. |

As you can see, there’s no one-size-fits-all answer, so always check the specific rules for your destination country and chosen university.

University Rules and How to "Waive" Them

On top of visa regulations, your university will have its own insurance playbook. Many schools in the U.S., for instance, automatically sign up international students for a university-sponsored health plan. These plans are usually pretty good, but they can also be seriously expensive.

Luckily, most schools offer a way out called an insurance waiver. This lets you opt-out of their pricey plan if you can prove you have another policy that’s just as good, or even better. To get a waiver approved, your private plan will have to tick every box on a strict checklist from the school. This usually includes things like minimum coverage amounts, limits on deductibles, and access to doctors and hospitals in the local area.

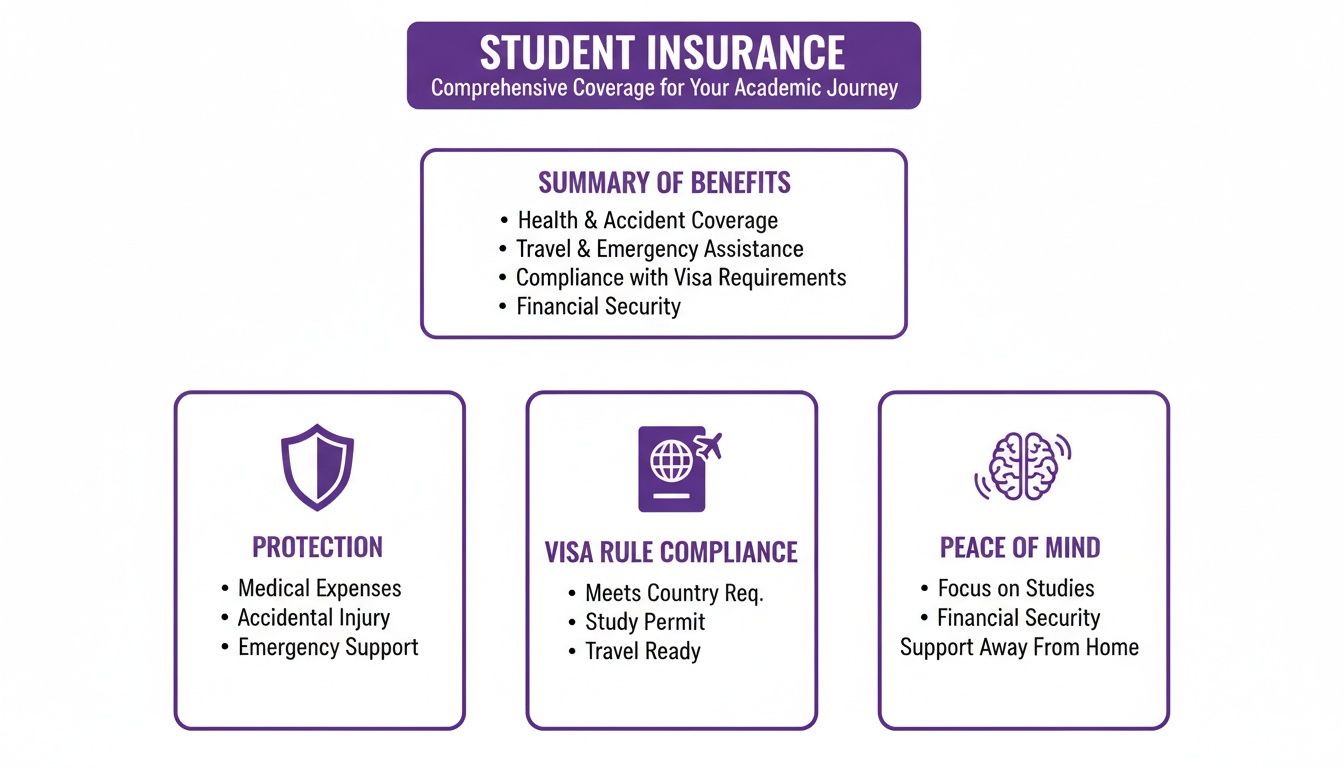

This handy infographic breaks down why sorting out your insurance is so critical for your journey.

It shows how the right insurance gives you vital protection, helps you meet visa rules, and ultimately gives you the peace of mind to just focus on your degree.

And while you're planning for your health, don’t forget that insurance can cover more than just doctor visits. You can find some awesome discounts on student travel insurance to protect your trips and your gear during semester breaks. It’s a smart move

Comparing University Plans vs Private Insurance

Once you've figured out what your visa and university demand, you'll hit a fork in the road. This is the big decision: do you stick with the university-sponsored health plan, or do you venture out and find a private one?

Think of it like choosing between your university's meal plan and buying your own groceries. One is built-in and convenient, but the other gives you way more flexibility and the chance to save some serious cash.

The University-Sponsored Plan Breakdown

Many universities, especially in the US, make life easy by automatically enrolling you in their own health insurance plan. You don't have to lift a finger. It’s usually a rock-solid, comprehensive option designed to cover all the bases and meet every possible requirement.

These plans are typically robust. They offer excellent coverage and great access to on-campus health services and local clinics. And because the university has already given it the green light, you can be 100% certain it ticks every box for your visa and school rules. No stress, no compliance headaches.

The biggest catch? The cost. University plans are often a lot more expensive than private alternatives. You’re essentially paying a premium for maximum convenience and guaranteed compliance, which might not be the best fit if you’re trying to keep your budget in check.

Key Takeaway: University plans are the "plug-and-play" option. They guarantee you're compliant and give you solid coverage, but that peace of mind usually comes with a higher price tag bundled right into your student fees.

Exploring the World of Private Insurance

This is where you can take back control. Private health insurance offers a powerful alternative, letting you shop around for the best coverage at the best price. These plans are specifically designed for international students and are built to be competitive, often providing similar benefits to university plans for a fraction of the cost.

This route is perfect for students who don't mind doing a little homework to find a policy that fits their needs and budget. The main hurdle you'll face is the university's waiver process. You have to prove that your private plan is "as good as or better than" the school's plan, which means you'll need to compare the details carefully.

Here’s a quick look at how the two options generally stack up.

| Feature | University-Sponsored Plan | Private Insurance Plan |

|---|---|---|

| Cost | Typically higher, bundled with tuition. | Often more affordable with flexible pricing. |

| Convenience | Automatic enrollment, no shopping needed. | Requires research and a waiver application. |

| Compliance | Guaranteed to meet all requirements. | Must be carefully checked against waiver criteria. |

| Flexibility | One-size-fits-all coverage. | Multiple plan levels and options to choose from. |

| Provider Network | Strong local network, especially on-campus. | Can vary; look for large, nationwide networks. |

This table really gets to the heart of the trade-off. Are you willing to pay more for the zero-hassle convenience of a university plan? Or would you rather put in a bit of time to find a private plan that could save you hundreds, maybe even thousands, of dollars?

When to Consider Short-Term or Travel Insurance

Beyond these two main paths, there are a couple of other options you might need in specific situations.

- Short-Term Plans: These are lifesavers for covering gaps in your insurance. For example, if you land in the country a few weeks before your main university plan kicks in, a short-term policy makes sure you’re protected from day one.

- Travel Insurance: This is for your holidays and weekend trips, not for your entire academic year. It’s designed to cover things like cancelled flights, lost bags, and medical emergencies while you're traveling, but it won’t be comprehensive enough to meet student visa or university waiver rules.

It’s crucial to know the difference. If you’re planning a spring break adventure or a weekend getaway, travel insurance is a smart move. For those interested, you can check out student discounts on travel insurance from Cover-More to get extra peace of mind for your trips away from campus.

Ultimately, whether you choose a university plan or private insurance comes down to your budget, how comfortable you are with the waiver process, and your personal health needs.

How to Choose the Right Health Insurance Plan

Picking the right health insurance plan can feel like you’re trying to decipher a secret code. With so many different terms and options flying around, it's super easy to get overwhelmed. But choosing a policy isn't a random guess—it’s all about matching your specific needs with the right coverage so you’re protected without burning a hole in your pocket.

Think of it like putting together a toolkit for your health. You need the right tools—like deductibles, provider networks, and coverage limits—to handle any situation, from a simple check-up to a serious emergency. This section will walk you through a practical checklist to evaluate plans like a pro, helping you choose your health insurance with total confidence.

Decoding the Fine Print: Key Insurance Terms

Before you can even start comparing plans, you need to speak the language. Getting a handle on a few key terms will empower you to see exactly what you’re paying for and what you’ll owe if you need medical care. It’s the difference between feeling in control and getting hit with a surprise bill.

To help you get started, here's a quick rundown of the essential jargon you'll find in almost every policy document.

| Term | What It Means for You | Example |

|---|---|---|

| Deductible | The amount you must pay out-of-pocket for medical services before your insurance starts paying its share. | If your plan has a $500 deductible, you'll cover the first $500 of your healthcare costs for the year. |

| Co-pay | A fixed fee you pay for a specific service each time you use it, like a doctor's visit or prescription. | Your plan might have a $30 co-pay for every visit to a general practitioner, no matter the total cost of the visit. |

| Out-of-Pocket Max | The absolute most you will have to pay for covered medical costs in a policy year. It’s your financial safety net. | Once you hit this limit, your insurance plan pays 100% of all covered costs for the rest of that year. |

Understanding these three terms is the first step to figuring out your potential healthcare costs and picking a plan that actually fits your budget.

Assess the Provider Network

Where you can get medical care is just as important as what’s covered. Every insurance plan has a provider network, which is a list of doctors, hospitals, and clinics that have agreed to give services at a discounted rate. Sticking with providers inside this network will save you a ton of money.

Before you commit to a plan, always check its provider network. You'll want to make sure there are in-network doctors and hospitals conveniently located near your campus and home. A plan with a big, nationwide network gives you more flexibility, which is great if you plan to travel within the country during your studies.

Choosing a plan without checking the local network is like buying a gift card for a store that doesn’t exist in your city. It may seem like a good deal, but it’s useless if you can’t access it easily.

Identify Your Coverage Must-Haves

Not all plans are created equal. While most policies will cover the basics like doctor visits and emergency room trips, you need to look closer to ensure the coverage matches your personal health needs. Every student is different, so your insurance should be, too.

Here are some essential coverage areas to look for:

- Prescription Drugs: Check how the plan covers medications. Some have separate deductibles or different price tiers for various types of drugs.

- Mental Health Support: University life can be stressful. Make sure your plan provides solid coverage for therapy, counseling, and other mental health services. This is a crucial part of your overall well-being.

- Specialist Care: If you need to see a specialist like a dermatologist or a cardiologist, confirm that your plan covers these visits. You'll also want to find out if you need a referral from your main doctor first.

Beware of Common Exclusions

Finally, it’s just as crucial to understand what a plan doesn’t cover. These are called exclusions, and they are often buried deep in the policy documents. Ignoring them can lead to some seriously expensive and unexpected medical bills down the road.

Common exclusions in international student health plans often include:

- Pre-existing Conditions: Some plans might not cover treatment for health issues you had before the policy started, or they might make you wait a certain period before coverage kicks in.

- Routine Dental and Vision Care: Basic health plans typically don’t cover routine eye exams, glasses, or dental cleanings. These usually require a separate, specialized insurance plan.

- Elective or Cosmetic Procedures: Any treatments that aren’t considered medically necessary are almost never covered.

By carefully checking the policy for these details, you can avoid costly surprises and choose a plan that truly has your back when you need it most.

Smart Ways to Save on Your Student Health Plan

Let's be real, health insurance is a must-have, but it shouldn't cost you an arm and a leg. As an international student, every dollar counts, and your insurance premium is a big chunk of your budget. The good news? With a few savvy moves, you can slash the cost of your health insurance without compromising on the important stuff.

Think of it like shopping for a new laptop. You wouldn't just grab the first one you see, right? You'd compare specs, read reviews, and hunt for the best deal. We're going to apply that same smart-shopper logic to your health plan, and it all starts with your university.

Master the University Insurance Waiver

Most universities automatically sign you up for their own health plan. It’s convenient, sure, but these plans are almost always more expensive. The single biggest money-saving hack is to get an insurance waiver.

A waiver is basically your get-out-of-jail-free card. It lets you opt out of the pricey uni plan by showing you’ve got another private insurance policy that meets their standards. Honestly, this one move can save you hundreds, sometimes even thousands, of dollars a year.

Getting your waiver approved means you need to be on top of your game.

- Get the Checklist: Your uni will have a list of non-negotiable coverage requirements. Find it on their international student office website.

- Compare Like a Pro: As you shop for private plans, hold them up against the university's checklist. Tick every box.

- Don't Miss the Deadline: Seriously, set a reminder for the waiver deadline. If you miss it, you're stuck with the school's plan and its hefty price tag.

Nailing the waiver process is your golden ticket to huge savings. It lets you pick a more budget-friendly private plan that still gives you solid coverage—the best of both worlds.

Stick to Your Provider Network

One of the easiest ways to avoid surprise medical bills is to always use doctors and hospitals that are "in-network." Think of a network as a club of healthcare providers who have a special deal with your insurance company to charge lower rates.

If you go "out-of-network," your insurance will cover way less of the bill—sometimes nothing at all. That leaves you paying the difference, which can be massive. Before you book any appointment, jump on your insurer's website or app and use their search tool to make sure the doctor or clinic is in your network.

More Practical Tips to Keep Costs Down

Beyond waivers and networks, a few simple habits can make a real difference to your bank balance.

- Pay Annually: If you can swing it, pay your entire year's premium in one go. A lot of insurance companies tack on little admin fees for monthly payments, so paying annually is a sneaky way to dodge those extra charges.

- Consider a Higher Deductible: If you're generally healthy and don't visit the doctor often, choosing a plan with a higher deductible can really lower your monthly premium. A deductible is what you pay out-of-pocket before your insurance kicks in. It's a trade-off: you pay less each month, but you'll pay more upfront if you do need medical care.

Navigating the Claims Process Without Stress

Having health insurance is one thing, but knowing how to actually use it when you need it is where the real value kicks in. Filing a claim—which is basically just asking your insurance company to pay for your medical care—can sound a bit daunting at first. Don’t worry, it's actually pretty straightforward once you get the hang of it.

Think of a claim as the official request you send your insurer after a doctor's visit. It’s your way of saying, "Hey, I used this medical service, and my policy says you’ll help cover the cost." Getting this right from the start means no annoying delays or headaches later on.

Direct Billing vs Reimbursement

When it comes to paying for medical care, you’ll usually run into two main scenarios. Figuring out which one applies to you is key to managing your money after an appointment.

- Direct Billing: This is the dream scenario. If your doctor or clinic is in your insurance plan's network, they’ll often bill the insurance company straight away. You just pay your bit (the co-pay or deductible) at the front desk, and the clinic sorts out the rest. Easy peasy.

- Reimbursement: Sometimes, you’ll have to pay the full cost of the medical service yourself, right then and there. If this happens, you’ll need to submit a claim to your insurer to get back the money your plan covers. This is pretty common if you see a doctor who isn't in your plan's network.

Your Step-by-Step Claims Checklist

Filing a reimbursement claim is all about getting your paperwork in order. If you have everything you need from day one, you’ll avoid the claim getting stuck in limbo or, even worse, denied.

- Get an Itemized Receipt: This is non-negotiable. After your appointment, always ask for a detailed receipt or invoice. It needs to clearly list every single service you received and what it cost.

- Fill Out the Claim Form: Your insurance provider will have a claim form you can download from their website. Fill it out completely and double-check that all the details are accurate.

- Attach Your Documents: Make copies of everything. Attach the itemized receipt, any notes from the doctor about your diagnosis, and any other relevant medical records.

- Submit and Track: Send the completed form and all your attachments to the insurer. Most have an online portal which is the fastest way, but mail is sometimes an option. You should get a claim number that you can use to track its progress online.

Pro Tip: Keep digital and physical copies of everything you submit. Having your own complete record—including when you sent it and any tracking numbers—is a lifesaver if you need to follow up or challenge a decision.

What to Do If Your Claim Is Denied

Getting a denial letter in the mail can be pretty stressful, but it’s not always the end of the road. Your first move is to read that letter carefully and find the exact reason they denied the claim. Often, it's something simple like missing information, a service that isn't covered, or the insurer thinking it was a pre-existing condition.

If you think they've made a mistake, you have the right to file an appeal. This usually means writing a letter explaining why the claim should be covered and including any extra documents to back up your case, like a letter from your doctor. Your policy documents will spell out the exact appeals process and any deadlines you need to hit.

Your Top Health Insurance Questions, Answered

Alright, let's tackle some of the nitty-gritty questions that pop up when you're sorting out health insurance. Think of this as your go-to cheat sheet for clearing up any last-minute confusion.

What's The Difference Between HMO and PPO Plans?

This one stumps a lot of people, but it’s pretty simple when you break it down. Think of it like choosing between a guided tour (HMO) and an all-access travel pass (PPO).

-

HMO (Health Maintenance Organization): With an HMO, you're basically sticking to a specific network of doctors and hospitals. You pick a primary care physician (PCP) who's your main point of contact for everything. Need to see a specialist? You'll need a referral from your PCP first. The trade-off for less flexibility is usually a lower monthly cost.

-

PPO (Preferred Provider Organization): A PPO gives you a lot more freedom. You can see doctors both inside and outside the network without a referral. You'll pay way less if you stay in-network, but the choice is yours. This flexibility usually means a higher monthly premium.

For most international students landing in a new country, a PPO plan is often the more convenient choice. The freedom to choose your doctors without jumping through hoops is a huge plus when you're still finding your feet.

How Are Pre-Existing Conditions Handled?

A pre-existing condition is just a fancy term for any health issue you had before your new insurance plan kicked in—think things like asthma, diabetes, or an old sports injury. How insurers deal with these can be a real mixed bag.

Some plans have a waiting period, meaning they won't cover anything related to that condition for a while, maybe six to twelve months. Others might cover you right away. If you have a pre-existing condition, you absolutely have to read the fine print here to avoid getting hit with a surprise bill.

Pro tip: Always be upfront about your health history when you sign up. Trying to hide a condition can lead to your claim being denied later, leaving you to foot the entire bill yourself. It’s just not worth the risk.

Can I Add My Family To My Plan?

Yep, in most cases you can! Many student health plans let you add dependents, like a spouse or children, to your policy. This is usually called a "family plan" or "dependent coverage."

Just remember, adding family members will bump up your premium. You’ll also need to double-check that the coverage is solid enough for everyone and meets any specific visa rules for your dependents (like for J-2 visa holders).

What If I Have A Medical Emergency Without My Card?

First off, don't panic. In a real emergency, getting medical help is the only thing that matters. Head straight to the nearest emergency room. Hospitals are required to treat you, insurance card or not.

You can sort out the insurance details later. Once you're able, just call your insurance provider and let them know what happened. They all have 24/7 helplines for exactly this kind of situation.

Making your student budget stretch further is what we're all about. At Student Wow Deals, we hunt down the best discounts on everything from health and wellness to travel and tech, so you can save your cash for what really matters. Check out our exclusive student offers today and start saving