Navigating college life means managing your finances, and a credit card is a powerful tool for building a strong financial future. But not all cards are created equal. The best credit cards for students offer more than just a way to pay; they provide valuable rewards, charge low or no fees, and report to credit bureaus to help you build a positive credit history from day one. Choosing the right card sets the stage for future financial milestones, like qualifying for a car loan or renting your first apartment after graduation. This responsible first step is a key part of your overall financial education. As you embark on your financial journey, it's also an opportune moment to learn foundational principles about managing your money; you can even explore wider financial planning by learning how to start investing as a beginner to get a head start.

This guide simplifies the process by breaking down the top student-focused cards and the most reliable comparison platforms to find them. We'll help you find the perfect fit for your specific spending habits and financial goals.

We get straight to the point, providing a clear, ranked comparison of top options from issuers like Discover, Capital One, Bank of America, and Chase. You will also learn how to use essential research platforms like NerdWallet, Bankrate, and The Points Guy to compare offers and make an informed decision. Each recommendation includes specific details on:

- Rewards and Perks: Cash back on dining, groceries, gas, and streaming.

- Fees and APR: Annual fees, foreign transaction fees, and interest rates.

- Credit-Building Features: How each card helps you build your credit score.

- Eligibility Requirements: What you need to qualify, even with limited credit history.

Our goal is to give you actionable insights to select a card confidently. Let's find the one that works as hard as you do.

1. Discover

Discover stands out as a top choice for students just beginning their credit journey, offering a user-friendly platform and two dedicated student credit cards designed to build credit while earning rewards. The issuer is well-regarded for its straightforward online application process and lenient eligibility requirements, making it one of the most accessible options for those with a limited or nonexistent credit history. This focus on beginners makes it a strong contender for the best credit card for students.

The platform’s strength lies in its simplicity and value. Students can choose between two primary cards, both with a $0 annual fee, which is a crucial feature for anyone on a student budget. The user experience is managed through a highly-rated mobile app, where you can monitor spending, pay your bill, and access security features like "Freeze it" to instantly lock your card if it's misplaced.

Key Offerings and Features

Discover's student-centric approach is evident in its card offerings and features. Both cards report to all three major credit bureaus (Experian, Equifax, and TransUnion), ensuring your responsible use helps build a strong credit profile.

- Discover it® Student Cash Back: This card is ideal for students who want to maximize rewards. It offers 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, and gas stations, up to the quarterly maximum when you activate. All other purchases automatically earn 1% cash back.

- Discover it® Student Chrome: For those who prefer simplicity, this card offers 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, plus 1% on all other purchases. There are no rotating categories to track or activate.

The standout feature for both cards is the Cashback Match™ program. Discover automatically matches all the cash back you’ve earned at the end of your first year, with no limit. If you earn $150 in cash back, Discover turns it into $300. This is an incredibly generous bonus for a starter card.

Pros and Cons

| Pros | Cons |

|---|---|

| Generous First-Year Bonus: The Cashback Match effectively doubles your rewards in the first year. | Category Activation Required: The 5% card requires you to activate new categories each quarter. |

| No Annual Fee: Both student cards come with a $0 annual fee, saving you money. | Limited International Acceptance: Discover is less widely accepted outside the U.S. compared to Visa or Mastercard. |

| Builds Credit: Reports to all three major credit bureaus, helping you establish a credit history. | |

| Student-Friendly Tools: Features like free FICO® Score access and SSN alerts help you manage your credit. |

Actionable Tip: Before applying, use Discover’s online pre-approval tool. This lets you check your eligibility with a soft credit inquiry, which won’t affect your credit score, giving you a clear idea of your approval odds. Also, don't forget that as a student, you can often find additional perks; you can find deals and discounts from Discover and other brands by checking student-focused platforms.

Website: https://www.discover.com/credit-cards/student/it-card.html

2. Capital One

Capital One provides students with a powerful choice between two distinct reward structures, making it a flexible and compelling option for those building credit. The issuer is known for its modern digital platform and transparent application process, offering student-specific cards that cater to different spending habits. This adaptability, combined with student-friendly features, easily makes Capital One a top contender for the best credit cards for students.

The platform's appeal lies in its combination of valuable rewards and practical benefits. Both student cards come with a $0 annual fee and $0 foreign transaction fees, a significant perk for students planning to study abroad or travel internationally. The user experience is seamless, managed through a top-tier mobile app and website that offer tools for budget tracking, bill payments, and instant purchase notifications.

Key Offerings and Features

Capital One's commitment to the student market is clear in its tailored card offerings. Both cards report to all three major credit bureaus, helping you build a solid credit foundation for the future. They also offer a straightforward welcome bonus, typically around $50 after meeting a modest spending requirement.

- SavorOne Student Cash Rewards Credit Card: Perfect for the socially active student, this card offers an unlimited 3% cash back on dining, entertainment, popular streaming services, and at grocery stores. This makes it highly rewarding for everyday student expenses.

- Quicksilver Student Cash Rewards Credit Card: For those who value simplicity, this card provides a flat, unlimited 1.5% cash back on every purchase. There are no categories to track, making it an effortless way to earn rewards on everything from textbooks to late-night snacks.

Both cards provide access to Capital One's travel portal for booking flights and hotels, along with tools for credit management. The ability to choose a card that perfectly matches your spending style is a major advantage.

Pros and Cons

| Pros | Cons |

|---|---|

| Choice of Reward Structures: Pick between high-earning categories or simple flat-rate cash back. | Low Initial Credit Limits: New student accounts may start with a relatively low credit limit. |

| No Foreign Transaction Fees: Ideal for international students or those studying abroad. | Category Tracking Limitations: Some third-party payment apps may not properly categorize purchases for 3% rewards. |

| Low-Friction Welcome Bonus: The early spend bonus is achievable on a typical student budget. | |

| Good Travel Tools: Access to Capital One's travel portal is a useful perk for planning trips. |

Actionable Tip: Capital One’s pre-approval tool is your best first step. It lets you see which cards you'll likely qualify for without impacting your credit score. If you choose the SavorOne Student card, remember that the high rewards on dining can be amplified; you can find deals and discounts from Capital One partners and other brands on student-focused platforms to save even more.

Website: https://www.capitalone.com/credit-cards/students/

3. Bank of America

Bank of America offers a robust selection of student credit cards, making it an excellent platform for those who want to choose from multiple reward structures within a single, trusted banking ecosystem. The bank provides several distinct student-labeled cards, including travel and cash-back options, all conveniently located on one central hub. This variety makes it a strong candidate for one of the best credit cards for students, especially for those who may already have a banking relationship with BofA.

The platform is designed to guide students through the selection process with an online comparison tool and helpful financial education resources. All student cards come with a $0 annual fee, a critical feature for managing a tight budget. A major advantage is the ability to check for personalized offers using a pre-qualification tool that won’t impact your credit score, giving you confidence before you formally apply.

Key Offerings and Features

Bank of America’s strength is its diverse lineup, allowing students to pick a card that truly matches their spending habits. Because these are Visa products, they are widely accepted both in the U.S. and internationally.

- Bank of America® Unlimited Cash Rewards for Students: Perfect for straightforward rewards, this card offers a simple, flat 1.5% cash back on all purchases with no categories to track.

- Bank of America® Customized Cash Rewards for Students: This card offers more control, providing 3% cash back on a category of your choice (like gas, online shopping, or dining) and 2% at grocery stores and wholesale clubs, on up to $2,500 in combined choice category/grocery/wholesale club quarterly purchases. All other purchases earn 1%.

- Bank of America® Travel Rewards for Students: An ideal choice for students who study abroad or travel, this card earns an unlimited 1.5 points per dollar spent on all purchases. Points can be redeemed for statement credits to cover travel and dining expenses.

These cards also offer the potential for long-term value. If you become a Bank of America banking customer, you may eventually qualify for the Preferred Rewards program, which can boost your credit card rewards by 25% to 75%.

Pros and Cons

| Pros | Cons |

|---|---|

| Wide Selection of Cards: Multiple student-specific cards with different reward structures are available. | May Target Better Credit: Some cards may be geared toward students with good credit, posing a challenge for true beginners. |

| No Annual Fee: All student card options come with a $0 annual fee. | Complexity in Rewards: Category caps and rules on the Customized Cash card can be more complex than a simple flat-rate card. |

| Long-Term Banking Perks: Potential to earn more rewards through the Preferred Rewards program if you bank with BofA. | |

| Broad Acceptance: As Visa cards, they are accepted almost everywhere. |

Actionable Tip: Use the Bank of America "Check My Offers" pre-qualification tool on their website before applying. This soft-inquiry check lets you see which cards you're likely to be approved for without affecting your credit score, helping you apply with greater confidence.

Website: https://www.bankofamerica.com/credit-cards/student-credit-cards/

4. Chase (Freedom Rise)

Chase enters the student credit card market with a powerful and straightforward option, the Freedom Rise. This card is specifically designed for individuals who are new to credit, making it an excellent fit for students. Chase positions it as a stepping stone into its wider ecosystem of highly-regarded rewards cards, offering a clear pathway for financial growth. For students looking for one of the best credit cards for students from a major national bank, the Freedom Rise is a compelling choice.

The card’s appeal is its simplicity combined with the robust features of a leading financial institution. With a $0 annual fee, it eliminates a common barrier for students on a tight budget. Cardholders gain access to Chase's top-tier mobile app and online portal, which include valuable tools like Chase Credit Journey to monitor their credit score and learn about financial health.

Key Offerings and Features

The Chase Freedom Rise is built to be an accessible and rewarding starting point for building credit. It reports to all three major credit bureaus, ensuring that timely payments help establish a positive credit history.

- Simple Flat-Rate Rewards: The card offers a consistent 1.5% cash back on all purchases, with no rotating categories to track or activate. This makes it easy for busy students to earn rewards on everything from textbooks and tuition to late-night pizza runs.

- Autopay Incentive: Chase encourages responsible financial habits from the start. New cardmembers can earn a $25 statement credit after enrolling in automatic payments within the first three months of account opening, helping to ensure bills are paid on time.

- No Credit History Required: While having a Chase checking or savings account with a balance can increase your approval odds, it is not a requirement. The card is targeted at those just beginning their credit journey.

- Upgrade Pathway: After demonstrating responsible use, Chase may review your account for an upgrade to a higher-tier product like the Chase Freedom Unlimited® or Chase Freedom Flex℠. This provides a clear path to more valuable rewards without needing a new application.

Pros and Cons

| Pros | Cons |

|---|---|

| Simple, Universal Earn Rate: The 1.5% cash back on everything is easy to understand and use. | High Variable APR: The interest rates can be high, so it is crucial to pay the balance in full each month. |

| Trusted National Bank: Access to Chase's robust app and free Credit Journey tools. | Approval Odds Influenced by Banking: Having a Chase deposit account may improve your chances of approval. |

| Defined Upgrade Path: A clear route to more premium Chase cards as your credit grows. | |

| No Annual Fee: A student-friendly card with no annual cost. |

Actionable Tip: To improve your approval odds for the Chase Freedom Rise, consider opening a Chase checking account and maintaining a balance of at least $250. While not mandatory, this banking relationship can demonstrate financial stability to Chase and make your application more attractive.

Website: https://creditcards.chase.com/cash-back-credit-cards/freedom/rise

5. NerdWallet

NerdWallet serves as an essential research and comparison hub for students navigating the world of credit cards for the first time. Instead of being an issuer, it's an editorial platform that provides in-depth guides, reviews, and side-by-side comparisons of the best credit cards for students. Its strength lies in compiling and simplifying complex information, making it a powerful starting point to understand your options, compare key features, and find the card that best fits your financial situation.

The platform excels at providing objective context, helping you cut through the marketing jargon of different card issuers. Its regularly updated "best student credit cards" guide categorizes top picks by use case, such as "best for cash back" or "best for no foreign transaction fees." This curated approach simplifies the decision-making process, allowing students to quickly identify relevant options and click directly through to the official issuer websites to apply.

Key Offerings and Features

NerdWallet's value comes from its comprehensive, easy-to-digest content tailored to beginners. It equips you with the knowledge needed to make an informed choice before you commit to a specific credit card.

- Up-to-Date Editorial Guides: The platform maintains a flagship guide dedicated to student credit cards. This guide is frequently updated with the latest offers, rates, and expert recommendations, ensuring the information is current and relevant.

- Side-by-Side Comparisons: NerdWallet presents card information in clear, scannable formats. You can easily compare annual fees, APRs, rewards rates, and introductory offers for multiple cards at a glance, which is a huge time-saver.

- Deep-Dive Reviews: For each recommended card, you can access a detailed review that breaks down its benefits, drawbacks, and ideal user. These reviews often provide scenarios and practical examples of how to maximize a card’s value.

- Educational Resources: Beyond card listings, the site offers a wealth of primer content for first-time applicants, explaining concepts like the CARD Act, how to check your credit score, and what factors issuers consider for approval.

Pros and Cons

| Pros | Cons |

|---|---|

| Objective Editorial Context: Clear "best for" tags and unbiased reviews help match cards to your specific needs. | Terms Can Change: Card details can become outdated; always verify rates and terms on the issuer's site. |

| Efficient Research Tool: Serves as an excellent jumping-off point to compare options before applying directly with issuers. | Includes Non-Student Cards: Some guides may feature non-student alternatives that could be confusing for beginners. |

| Great for First-Time Applicants: Offers foundational knowledge on credit basics, eligibility, and responsible card use. |

Actionable Tip: Use NerdWallet as your first stop for research, but not your last. Identify two or three cards that look promising, read their detailed reviews, and then click through to the official issuer websites. Always double-check the fine print on the issuer’s application page, as offers and terms can change without notice.

Website: https://www.nerdwallet.com/article/credit-cards/student-credit-card-tips

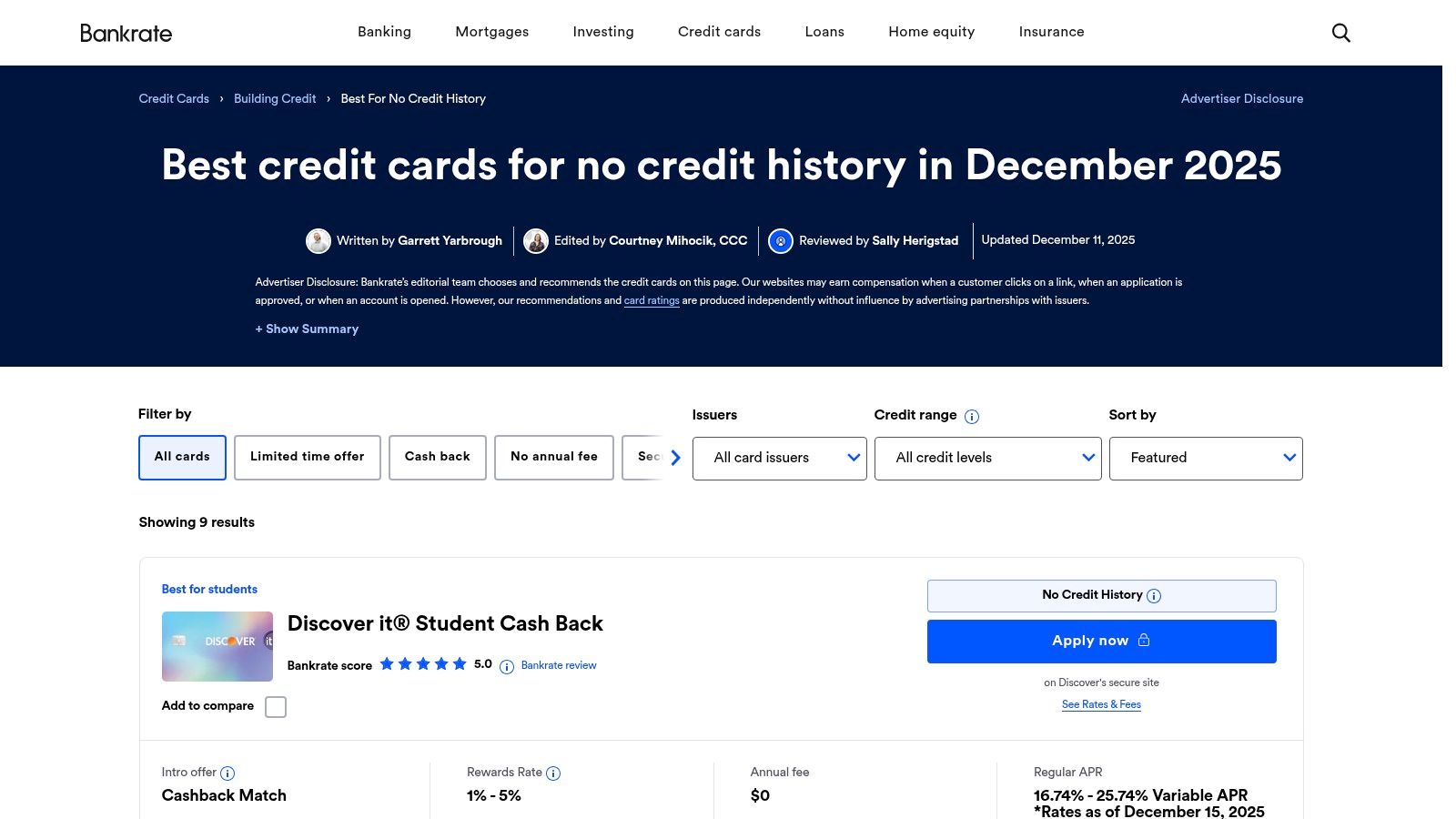

6. Bankrate

Bankrate serves as a comprehensive financial resource, offering in-depth reviews and data-driven rankings that empower students to compare credit cards effectively. Unlike a direct issuer, Bankrate provides an objective, criteria-based overview of the market, making it an essential research tool. For students trying to navigate their options, the platform’s detailed comparisons and expert analysis help demystify the process of finding the best credit cards for students, especially for those with no prior credit history.

The platform’s strength is its ability to organize and score numerous card options using a transparent methodology. Students can explore curated lists tailored to specific needs, such as "best for no credit" or "best for cash back," and see up-to-date information on APRs, fees, and sign-up bonuses. This allows for a side-by-side comparison that simplifies decision-making, ensuring you choose a card that truly fits your financial situation and goals.

Key Offerings and Features

Bankrate’s value lies in its analytical tools and educational content, which guide students toward making informed financial choices. The platform is free to use and provides a wealth of information that goes beyond simple product listings.

- Category-Specific Recommendations: Bankrate curates lists of the best student cards for different needs, such as building credit, earning rewards, or avoiding fees. This helps you narrow your search from the very beginning.

- In-Depth Product Reviews: Each card is accompanied by a detailed review that breaks down its rewards structure, benefits, fees, and potential drawbacks, giving you a complete picture before you apply.

- Bankrate Score Methodology: Cards are rated using a consistent, transparent scoring system. This allows for an objective comparison of different options based on factors like rewards value, annual fee, and introductory APR.

- Current Rate and Fee Snapshots: The site provides current ranges for variable APRs and highlights the latest introductory offers and bonuses, ensuring the information is timely and relevant.

Pros and Cons

| Pros | Cons |

|---|---|

| Trusted, Transparent Scoring: The clear scoring methodology helps you objectively compare cards. | Content Can Be Dispersed: Finding all relevant student card information may require navigating multiple pages. |

| Up-to-Date Information: Shows current APR ranges, bonuses, and fees, which is crucial for making timely decisions. | Affiliate Relationships: Bankrate earns commissions, so always verify final terms directly on the issuer's website. |

| Excellent for Comparison: Ideal for comparing similar student cards using consistent, data-driven criteria. | |

| Free Educational Resource: Provides valuable financial guidance at no cost to the user. |

Actionable Tip: Use Bankrate’s comparison tables to create a shortlist of two or three cards that fit your spending habits. Pay close attention to the "Bankrate Score" and the expert "Why we like it" sections for a quick summary, then dive into the full reviews to understand the nuances of each card before making your final choice.

Website: https://www.bankrate.com/credit-cards/building-credit/no-credit-student-cards/

7. The Points Guy (TPG)

The Points Guy (TPG) offers a unique, travel-focused perspective on the best credit cards for students. While many resources focus purely on cash back or credit building, TPG provides a curated guide that evaluates student cards through the lens of travel rewards. This makes it an invaluable platform for students who plan to study abroad, travel during breaks, or want to start building a points and miles strategy for post-graduation adventures. The platform excels at providing practical context on how to earn and redeem rewards effectively.

The strength of TPG's guide lies in its detailed analysis and clear presentation. The content uses easy-to-scan tables that highlight key features, reward categories, and "best for" use cases, allowing you to quickly compare options. Their editorial team provides up-to-date details on reward structures, such as Capital One's entertainment and travel portal rates, ensuring you have the latest information to make an informed choice. This approach benchmarks student cards against broader card ecosystems, giving you a forward-looking view of your credit journey.

Key Offerings and Features

TPG’s content is not just a list; it's a strategic guide that bridges the gap between basic student cards and more advanced travel rewards cards. It helps students understand how today's choices can impact their future travel goals.

- Travel-Leaning Recommendations: The guides often highlight student cards that earn transferable points or have strong co-branded partnerships with airlines and hotels, even if they are primarily marketed as cash-back cards.

- Practical Redemption Context: TPG doesn't just tell you what you'll earn; it explains what those rewards are worth and how to redeem them for maximum value, offering insights into airline partners and hotel loyalty programs.

- Editorial Benchmarking: The platform compares student-specific cards with mainstream, $0-annual-fee options, providing a comprehensive market overview. This helps you understand where each card fits within the larger credit card landscape.

- Current Reward Structure Details: The content is regularly updated to reflect changes in rewards programs, sign-up bonuses, and card benefits, making it a reliable source for current information.

Pros and Cons

| Pros | Cons |

|---|---|

| Practical Travel Perspective: Excellent for students who want to earn and use travel rewards. | Niche Focus: The travel-centric tilt may be less useful for students only interested in simple cash back. |

| Includes Beginner-Friendly Options: Features mainstream $0-fee cards well-suited to those new to credit. | May Suggest Non-Student Cards: Some highlighted alternatives may require a stronger credit history than a typical student has. |

| Strong Editorial Benchmarking: Compares student cards across different card ecosystems, providing valuable context. |

Actionable Tip: Use The Points Guy to understand the long-term value of a credit card. Instead of just looking at the cash-back rate, read their analysis on how a card’s rewards program can be leveraged for future travel. This will help you choose a card that not only builds credit but also aligns with your lifestyle goals. To maximize your savings, check out special offers and find student travel discounts that can complement your rewards strategy.

Website: https://thepointsguy.com/credit-cards/college-students-maximize-travel-rewards-cards/

Top 7 Student Credit Card Comparison

| Provider | 🔄 Implementation complexity | ⚡ Resource requirements | 📊 Expected outcomes | 💡 Ideal use cases | ⭐ Key advantages |

|---|---|---|---|---|---|

| Discover | Low — easy online application; rotating categories require activation/tracking | Low — $0 annual fee; minimal time to manage rotations | High first‑year return (Cashback Match); moderate ongoing rewards | Beginners who want strong first‑year cash back and app security tools | Generous first‑year Cashback Match; strong app features; rotating 5% & 2% options |

| Capital One | Low — simple product choices (flat vs category) | Low — $0 fee; no foreign transaction fees on eligible cards | Steady flat or targeted category earnings; modest welcome bonus | Students who prefer flat cash back or dining/entertainment rewards; travel | Choice of earning styles; travel tools; straightforward pre‑approval |

| Bank of America | Medium — multiple student options and decision tools | Moderate — $0 fees but some cards target higher credit | Varied outcomes by card; potential long‑term perks via bank relationship | Students wanting several card options and to leverage bank ecosystem | Multiple student cards in one hub; broad acceptance; personalized offers |

| Chase (Freedom Rise) | Low — simple flat‑rate product aimed at new‑to‑credit users | Low — $0 fee; autopay incentive; may benefit from deposit accounts | Modest steady rewards (1.5%); clear upgrade pathway to higher Chase cards | New‑to‑credit students seeking simplicity and route to premium cards | Simple universal earn rate; upgrade pathway; robust app & Credit Journey tools |

| NerdWallet | Low — editorial hub for comparison and guidance | Low — time to read guides; no fees | Better informed card selection; fast issuer comparison | Students beginning research who need “best for” recommendations | Up‑to‑date editorial picks, clear use‑case tags, direct issuer links |

| Bankrate | Medium — in‑depth reviews and scoring methodology to parse | Moderate — time to review multiple pages; no fees | Criteria‑driven comparisons and APR/bonus snapshots | Students wanting objective scoring and detailed product analysis | Transparent Bankrate Scores; detailed product reviews and data |

| The Points Guy (TPG) | Low–Medium — travel‑focused editorial with benchmarking | Moderate — time to read travel/redemption guidance | Strong travel‑reward guidance; practical redemption context | Students prioritizing travel rewards or planning study abroad | Travel‑centric redemption insight; ecosystem benchmarking and examples |

Your Next Move: Choosing and Using Your First Card Wisely

Navigating the world of student credit cards can feel complex, but after exploring the top options from issuers like Discover, Capital One, Bank of America, and Chase, you're now equipped with the knowledge to make an informed decision. We’ve also seen how comparison tools like NerdWallet and Bankrate, along with expert resources such as The Points Guy, can demystify the fine print and help you pinpoint the perfect card for your unique financial situation. The journey, however, doesn't end with a successful application. Your first credit card is not just a payment method; it's a powerful tool for building your financial future.

Choosing the best credit card for students is a critical first step, but how you manage it will define its true value. The goal is to establish a strong credit history that will serve you long after graduation, unlocking better rates on future car loans, mortgages, and more.

From Application to Smart Management: Your Action Plan

Before you hit "submit" on an application, take a moment to strategize. Many issuers, including Capital One and Discover, offer pre-approval tools. These are invaluable resources that allow you to check your eligibility without a "hard inquiry" that could temporarily lower your credit score. This simple step helps you apply with confidence and avoid unnecessary rejections.

Once you have your card, the focus shifts to responsible use. Here are the non-negotiable rules for building an excellent credit score:

-

Pay On Time, Every Time: This is the single most important factor in your credit score. A single late payment can have a significant negative impact. To make this foolproof, set up automatic payments for at least the minimum amount due. You can always pay more manually, but this ensures you never miss a deadline.

-

Keep Your Utilization Low: Credit utilization is the percentage of your available credit that you're using. For example, if you have a $500 limit and a $150 balance, your utilization is 30%. Experts recommend keeping this ratio below 30%, and ideally below 10%, to show lenders you are not overly reliant on debt.

-

Monitor Your Spending: Use your card issuer's mobile app to track purchases in real-time. This habit helps you stay within your budget and spot any fraudulent activity immediately. A student credit card should simplify your finances, not complicate them.

Mastering Your Financial Habits

Building credit is a marathon, not a sprint. While rewards like cash back and travel points are fantastic perks, they should never tempt you into overspending. It's crucial to treat your credit card like a debit card, only charging what you can afford to pay off in full each month. This discipline prevents you from falling into a cycle of debt.

If you ever find yourself carrying a balance, it's vital to have a strategy to eliminate it. Understanding how to pay off credit card debt quickly is a fundamental financial skill that will protect your credit score and save you from costly interest charges. Your first card is an opportunity to practice these habits when the stakes are relatively low.

Ultimately, the best credit cards for students are those that align with your spending patterns, offer achievable rewards, and have no annual fee. Whether you prioritize a simple cash-back structure, good grades rewards, or a high approval chance, the right card for you is on our list. Make your choice, manage it wisely, and you'll be laying a solid foundation for decades of financial success.

Ready to maximize the value of your new student credit card? Join Student Wow Deals to unlock exclusive discounts on everything from tech and textbooks to food and fashion. Pair your card's rewards with our deals to supercharge your savings and make your money go further. Sign up for free today at Student Wow Deals and start spending smarter