If you’re a full-time student, apprentice, or trainee in Australia, you know that every dollar counts. The Bendigo Bank Student Account is one of those banking products designed with your specific needs in mind. It’s a straightforward transaction account aimed at making your daily money management simple and, most importantly, cheap.

So, What Exactly Is a Bendigo Bank Student Account?

Think of it as your financial home base while you’re studying. It’s not a complicated investment account or a credit card with tricky terms. Instead, it’s a simple, effective toolkit for handling your day-to-day cash flow—whether that’s getting paid from your part-time barista gig, paying for textbooks, or splitting a pizza with mates.

The whole point of this account is to strip away the usual banking clutter and fees that can slowly eat away at a student budget. It focuses on the essentials, giving you a reliable place to keep your money without worrying about surprise costs.

Who Is This Account Really For?

Bendigo Bank has a pretty clear audience in mind for this one. It’s built for young Aussies who are deep in study or training. You’ll fit the bill if you are:

- A full-time student enrolled at a recognised Aussie school, TAFE, or uni.

- An apprentice or trainee currently in a formal training program.

- On the younger side—you can open an account from age 12 and up.

This sharp focus means the account’s features are genuinely useful for someone living the student life, which often involves a tight budget, a fluctuating income, and the need for easy, fee-free access to your cash.

To give you a quick snapshot, here’s a simple breakdown of what the Bendigo Bank Student Account offers.

Bendigo Bank Student Account At a Glance

| Feature | Details |

|---|---|

| Monthly Fees | $0 (No account-keeping fees) |

| Eligibility Age | 12+ |

| Who Can Apply? | Full-time students, apprentices, and trainees |

| ATM Access | Unlimited free withdrawals at Bendigo Bank ATMs |

| EFTPOS | Unlimited free transactions |

| Minimum Deposit | Just $1 AUD to open the account |

As you can see, the low barrier to entry and lack of fees make it a seriously practical option for almost any student.

When you’re signing up for any new account that handles your personal data, it’s a good time for a quick digital safety check-in. Getting familiar with the basics of Data Privacy for Students is a smart move to protect yourself online.

And while you’re saving money on bank fees, don’t forget to make your cash stretch even further by hunting down some killer student discounts at https://studentwowdeals.com/au/.

The Everyday Benefits of This Student Account

Banking features can sound a bit dry, but what really matters is how they help you get through the week. The Bendigo Bank Student Account is built to be more than just a place to stash your cash; it’s a tool that makes your financial life simpler so you can actually focus on your studies. These aren’t just abstract perks—they translate into real savings and way less stress.

The biggest win right off the bat? No monthly account-keeping fees. As a student, every dollar counts. Even a small $5 monthly fee adds up to $60 over a year. That’s money that could go towards textbooks, groceries, or a much-needed night out with mates. This fee-free setup means your money from that casual job or your study allowance actually stays yours.

Spend Your Money Freely and Securely

On top of saving on fees, this account gives you the freedom to use your money without getting hit by surprise charges. You get unlimited fee-free EFTPOS transactions, which is a game-changer. Tap your card for a morning coffee, pay for groceries, or split a dinner bill as many times as you like without ever seeing an extra charge pop up.

Need cash? No problem. You also get unlimited free withdrawals from any Bendigo Bank ATM. This is perfect for those times you need actual cash for a market stall or to pay back a friend without hunting for the “right” ATM to avoid a fee.

It’s all about creating some financial predictability. You know exactly what you can do with your money without having to second-guess hidden costs, which is a small but mighty relief for any student.

Your Digital Wallet and Safety Net

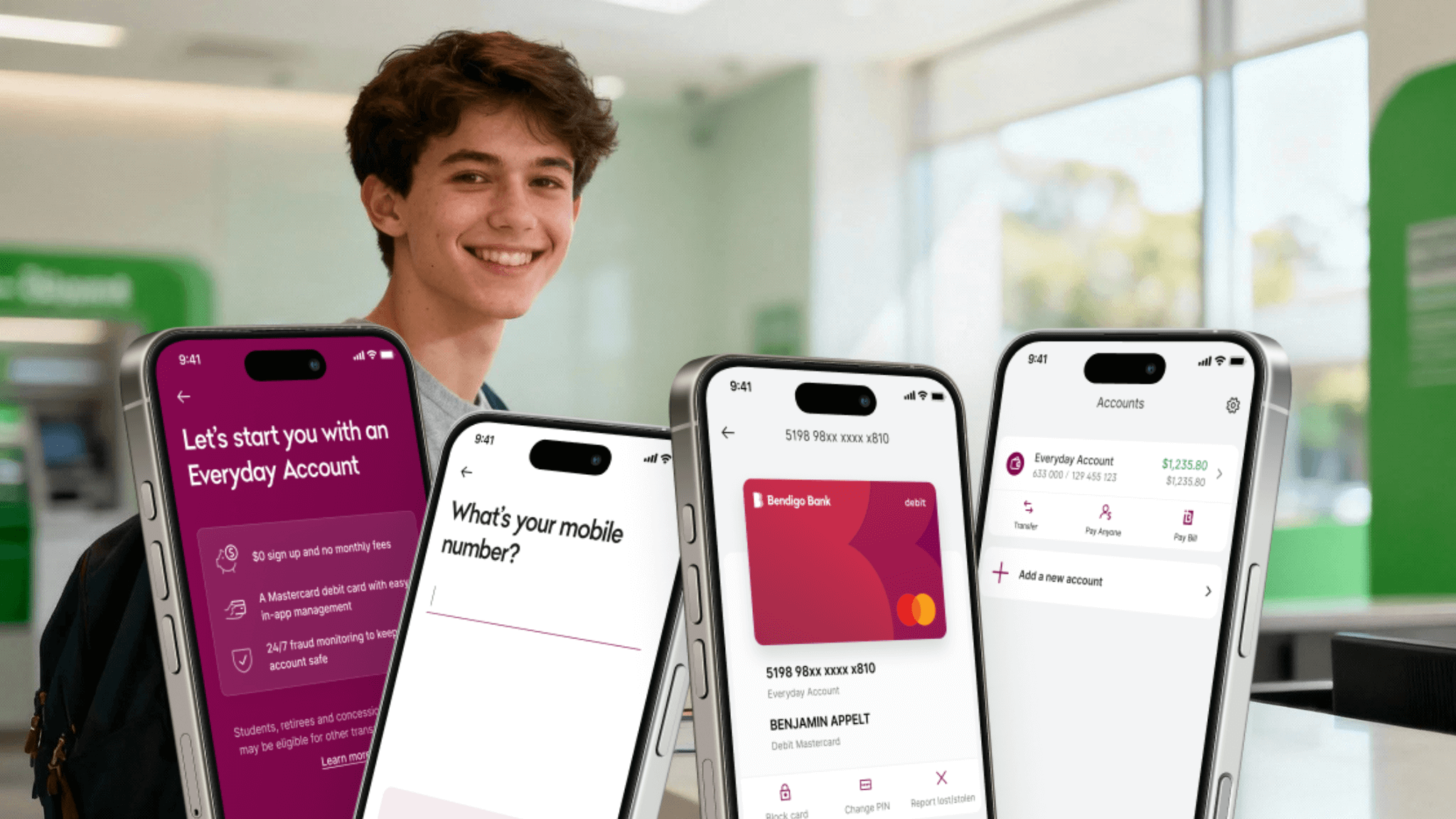

Every Bendigo Bank Student Account comes with a Debit Mastercard, which is your key to spending both online and in person. This isn’t just any old card; it’s a secure pass to the digital world, backed by some serious safety features.

Here’s how it’s got your back day-to-day:

- 24/7 Fraud Monitoring: The bank’s systems are always on the lookout for weird activity on your account, helping to catch dodgy transactions before they turn into a massive headache.

- Secure Online Shopping: Use your card to safely buy whatever you need online, from course materials to concert tickets, knowing you’re protected. This is super handy when you’re trying to sell your used textbooks safely online and need a secure account for the funds.

- Worldwide Acceptance: It’s a Mastercard, so it’s accepted pretty much everywhere. That gives you huge flexibility whether you’re shopping down the road or planning a trip for the uni break.

This combo of no monthly fees and secure, unlimited transactions creates a powerful financial tool. It lets you manage your day-to-day expenses without a fuss, save money on annoying bank charges, and confidently buy what you need online.

Ultimately, the perks of the Bendigo Bank Student Account are designed for the reality of student life. It gets rid of common financial hurdles and gives you a simple, cheap, and secure way to handle your money so you can concentrate on what really matters—your education.

Your Step-by-Step Application Guide

Alright, ready to get your hands on a Bendigo Bank Student Account? The whole process is refreshingly simple, whether you’re a click-and-go online person or someone who prefers a face-to-face chat at a local branch.

The secret to a super quick setup is just getting your ducks in a row before you start. Think of it like enrolling for a new unit—you just need to prove who you are and that you meet the prerequisites. In this case, that means showing you’re a student, apprentice, or trainee.

Who Is Eligible to Apply

First things first, let’s make sure this account is actually the right one for you. Bendigo Bank keeps the criteria pretty straightforward, focusing on anyone in full-time study or training.

You’re good to go if you are:

- A full-time student at an Australian secondary school, TAFE, or university.

- An apprentice or trainee currently in a formal training program.

- At least 12 years old.

If you’re nodding along to those points, you’re in! The next move is gathering a few documents. Getting this done now means you can knock over the application in one sitting, no annoying pauses required.

Gathering Your Essential Documents

To make the application for a Bendigo Bank Student Account an absolute breeze, you’ll just need a couple of key bits of info. This is so the bank can do its due diligence and confirm your identity and student status.

Here’s a quick checklist of what to have handy:

- Proof of Identity: This is the big one. Usually, a primary photo ID like a driver’s licence or passport is all you need. If you don’t have one of those, you can often use a combo of other docs, like your birth certificate plus a Medicare card.

- Proof of Enrolment or Training: You’ll need to show you’re an active student or trainee. Your current student ID card, a letter of offer from your uni or TAFE, or your official apprenticeship agreement will do the trick.

- Tax File Number (TFN): While you don’t have to provide this to open the account, it’s a really good idea. If you don’t, the bank legally has to withhold tax from any interest you earn at the highest possible rate. Ouch.

Pro Tip: Before you start the online application, snap some clear photos or scans of these documents on your phone. It’s a simple step that honestly saves a ton of faffing about later and gets your account approved faster.

Choosing Your Application Method

Bendigo Bank gives you a couple of ways to apply, so you can just pick whichever one suits you best.

You can either do it all online through their website, which is usually the quickest route, or pop into a local Bendigo Bank branch for some in-person help. The online form is really user-friendly and walks you through everything, but heading into a branch is great if you’ve got questions or just prefer dealing with a real person.

Either way, you end up with the same awesome, fee-free account to manage your money through your student years.

Understanding the Fees and Account Limits

Let’s be real, managing your cash on a student budget can feel like a tightrope walk. The best thing about the Bendigo Bank Student Account is that it has no monthly account-keeping fees, which is a massive win right from the start. But to really get on top of your finances, you need to know the whole story—including any sneaky charges that might pop up when you’re not looking.

While you won’t get stung with a monthly fee just for having the account, certain things can attract a charge. Think of them less as a penalty and more as a “user fee” that only kicks in when you use specific services. Most banks have these, but knowing what they are ahead of time means you can dodge them like a pro.

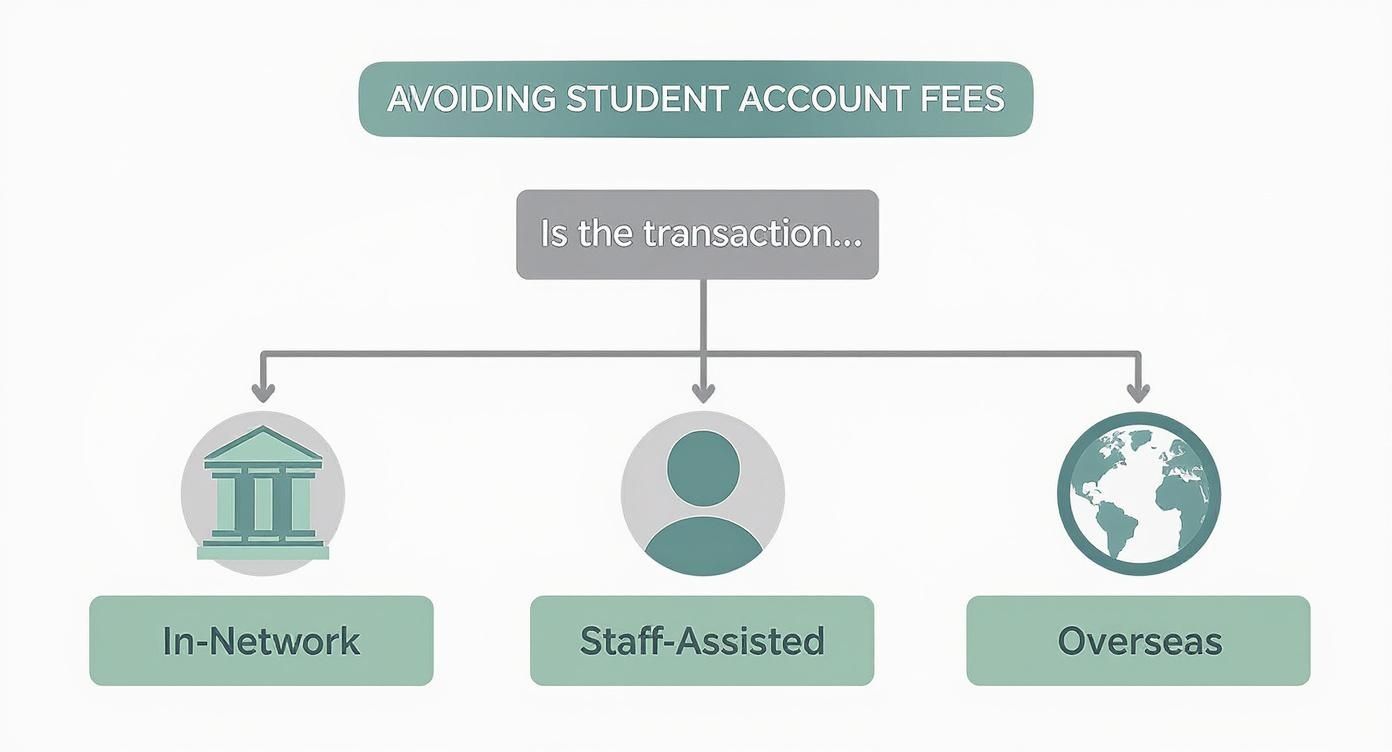

For instance, if you use an ATM that isn’t part of the Bendigo Bank network, you’ll probably get hit with a fee from that ATM’s owner. Another one to watch out for is getting a staff member in a branch to do a basic transaction for you (they call this a “staff-assisted” transaction), which can sometimes come with a small cost.

Common Fees and How to Avoid Them

The secret to keeping this account genuinely free is all about banking smart. A little bit of planning and making the most of the account’s digital perks will help you sidestep most of the potential costs.

Here’s your quick guide to staying ahead of the game:

- ATM Fees: Always hunt down a Bendigo Bank ATM. If there isn’t one nearby, just get cash out using EFTPOS when you’re buying groceries or snacks. It’s almost always free.

- In-Branch Fees: For simple stuff like checking your balance or flicking money to a mate, jump on the Bendigo Bank app or use online banking instead of heading into a branch.

- International Transaction Fees: Shopping on overseas websites or planning a trip? Keep an eye out for currency conversion fees. These are usually charged as a percentage of whatever you’re buying.

A great habit to get into is regularly checking your bank statements. To get a handle on your spending, it’s super important to understand what a bank statement shows, as it lists out every transaction and, you guessed it, any fees you might have been charged. It’s the best way to spot and stop unnecessary costs.

The goal here isn’t to memorise a boring list of fees. It’s about building smart banking habits. If you use the app for your day-to-day banking and stick to Bendigo’s ATM network, you can easily keep your banking completely free.

A Clear Look at Potential Costs

To make things crystal clear, here’s a simple table breaking down the common fees and, more importantly, how to avoid them.

Bendigo Student Account Fee Schedule

A clear breakdown of standard fees and charges to help you avoid unexpected costs.

| Transaction Type | Associated Fee | How to Avoid |

|---|---|---|

| Using a non-Bendigo Bank ATM | Varies (charged by the ATM owner) | Use Bendigo Bank ATMs or get cash out with EFTPOS. |

| Staff-Assisted Transactions | A small fee may apply | Use the mobile app or online banking for free. |

| International Purchases | Currency conversion fee applies | Plan for this fee on overseas online purchases. |

See? With a bit of know-how, it’s pretty straightforward to keep those fees at zero and make your money work for you, not the other way around.

How It Stacks Up Against Other Student Bank Accounts

Choosing a student bank account can feel a lot like picking a mobile plan—at first glance, they all look pretty much the same. But the little details in fees, ATM access, and app features can make a huge difference in your day-to-day life. Let’s put the Bendigo Bank Student Account head-to-head with the offerings from Australia’s “Big Four” to see where it really shines and where others might have the edge.

Pretty much every major bank, including Commonwealth Bank, Westpac, NAB, and ANZ, will offer you a student account that ditches the monthly account-keeping fee. This is the industry standard now, so while Bendigo’s $0 monthly fee is a massive plus, it’s a perk you can find almost anywhere. The real comparison starts when you dig a bit deeper.

One of the biggest battlegrounds is the ATM network. Bendigo Bank gives you unlimited free withdrawals from its own ATMs, which is great. The catch? Their network is smaller than the big players. If you’re in a regional town with a strong Bendigo presence, you’ll be sweet. But if you’re in a major city, you might find a Big Four ATM is always just around the corner, which could save you from copping fees for using another bank’s machine.

Digital Banking and Unique Perks

These days, a bank’s mobile app is just as important as its branches. Bendigo Bank has definitely put in the work to improve its digital tools, offering a clean, functional app that handles all your everyday banking needs. That said, some of the bigger banks are often a step ahead with more advanced features, like slick in-app spending trackers and goal-setting tools. If you live on your phone and love getting into the nitty-gritty of your finances, it’s worth downloading a few different banking apps to see which interface you vibe with before you commit.

The best student account isn’t the one with the most bells and whistles. It’s the one whose features actually fit your lifestyle. Think about where you live, your spending habits, and how tech-savvy you are to make the right call.

This infographic gives you a simple way to figure out how to dodge those annoying transaction fees, no matter which bank you end up with.

The main takeaway here is simple: banking smart is the key. Stick to your own bank’s network and use its digital tools, and you can keep your account genuinely fee-free.

The Community and International Angle

Where Bendigo Bank really sets itself apart is its community-first vibe and solid customer service reputation. As one of Australia’s most trusted banks, it often provides a more personal experience, which is a huge draw if you actually like talking to a human at a branch.

And what about overseas use? Most student accounts are pretty similar when it comes to international transaction fees. If you’re planning to study abroad or do some serious travelling, it’s crucial to compare the specific currency conversion fees. Even a 1% difference can add up to a lot of money over a long trip.

All in all, the Bendigo Bank Student Account is a strong, fee-free contender. It’s an especially good fit for students who value that community focus and have easy access to its ATM network.

More Than an Account: Bendigo Bank’s Community Focus

Let’s be real, choosing a bank as a student often comes down to one thing: who has the lowest fees. But what if your choice could do more? What if your bank actually invested back into your future and the community around you?

While many banks look the same on the surface, Bendigo Bank has carved out a reputation for being deeply involved in supporting young Australians. This isn’t just fluffy marketing talk; they put their money where their mouth is, making them more like a partner in your success than just a place to stash your cash.

A Genuine Investment in Your Education

The clearest proof of this is Bendigo Bank’s scholarship program. We’re not talking about a small, one-off giveaway here. This is one of Australia’s largest private scholarship funds, specifically designed to give a leg-up to students who need it most.

Since 2017, they’ve handed out over $15 million in scholarships to 2,304 students. What’s really cool is their focus on helping students from regional, rural, and Indigenous backgrounds get a fair shot at their dreams. You can read more about the bank’s commitment to empowering students on their site.

This isn’t just pocket change. It’s a massive, long-term program that has genuinely changed lives, making uni or TAFE a reality for thousands of students from all corners of the country.

This community-first attitude changes the whole dynamic. When you bank with them, you’re aligning your own money with an organisation that’s actively helping people just like you. Your banking choice indirectly supports fellow students, which is a pretty good feeling.

This philosophy trickles down to the local level, too. You’re supporting a business model that reinvests its profits back into local projects. It makes your everyday spending feel a bit more meaningful, especially when you pair it with hunting for local deals and discounts that also support businesses in your neighbourhood.

Got a few questions swirling around about the Bendigo Bank Student Account? It’s totally normal. Let’s clear up some of the most common ones.

What Happens to My Account After I Graduate?

So you’ve finally tossed that graduation cap in the air – congrats! Naturally, your banking needs are about to change. Bendigo Bank gets this and makes the transition super simple.

Once you’re officially a graduate, your student account will automatically switch over to one of their standard everyday accounts. Don’t worry, they’ll give you a heads-up before this happens, spelling out any new terms or potential fees. It’s a seamless switch, so you can focus on landing that dream job instead of fiddling with bank paperwork.

Can I Use My Debit Card Overseas?

Yep, you absolutely can! The Debit Mastercard that comes with your account is your ticket to spending pretty much anywhere in the world that accepts Mastercard. It’s a lifesaver for that grad trip or even just for grabbing stuff from international online stores.

Just be smart about the fees. When you pay for something in a different currency, you’ll usually get hit with a currency conversion fee. It’s typically a small percentage of what you bought, but it’s always a good idea to check Bendigo’s latest fee schedule before you jet off.

Quick heads-up: Pulling cash from an ATM overseas that isn’t a Bendigo Bank one will likely cost you. The local ATM operator will probably charge a fee, on top of anything your bank might charge.

Does Bendigo Bank Have a Mobile App?

Of course! Bendigo Bank has a really easy-to-use mobile banking app that puts everything you need right in your pocket. Honestly, it’s essential for managing your money these days.

With the app, you can:

- Instantly check how much money you have (or don’t have!).

- Flick money to a mate for your share of pizza or pay that annoying phone bill.

- Hook up your card to Apple Pay or Google Pay for quick tap-and-go payments.

It just makes handling your finances from your uni campus, home, or your part-time hospo job a total breeze.

Ready to make your student life more affordable? Join the Student Wow Deals community today for free and get instant access to hundreds of exclusive discounts on food, tech, fashion, and more. Visit https://studentwowdeals.com to start saving.