Let's be honest, "financial literacy" sounds like something your parents' accountant would talk about. Dry, complicated, and probably involving a lot of spreadsheets. But for students, it's actually much simpler and way more important.

Think of it as knowing how to handle your money with confidence. It’s about getting the hang of the basics—earning, budgeting, saving, and borrowing—so you can make smart choices now and set yourself up for a less stressful future.

What’s in Your Financial Toolkit?

Imagine trying to navigate a new city without a map. That's pretty much what managing your money as a student feels like without a bit of financial know-how. It’s not about becoming a Wall Street wizard overnight. It's a practical, real-world skill that helps you navigate the unique money situations you face at uni, from stretching a part-time job paycheque to understanding what a student loan actually costs you.

Getting a grip on this stuff means less stress and more control. And let's face it, that's something we could all use. The need for these skills is pretty urgent, too. Recent data from the TIAA Institute-GFLEC Personal Finance Index found that people aged 18-29 could only answer 38% of financial literacy questions correctly—the lowest of any generation. You can read more about those findings if you're curious, but the takeaway is clear: building these skills early is a massive advantage.

The Five Pillars of Student Financial Literacy

To really get what financial literacy for students is all about, it helps to break it down into five main areas. Each one is a crucial part of your financial toolkit, helping you manage your cash effectively from day one.

This handy table lays out these five pillars and what they actually look like in your day-to-day student life.

| The Five Pillars of Student Financial Literacy |

| :— | :— | :— |

| Pillar | What It Means for a Student | Real-World Example |

| Earning | Understanding where your money comes from and how to manage it. | Juggling pay from a part-time cafe job with your student loan payments. |

| Spending | Making conscious decisions about where your money goes. | Creating a weekly budget for groceries, transport, and a night out with mates. |

| Saving | Putting money aside for future goals, big or small. | Stashing away a bit of cash each week for a trip during the semester break. |

| Borrowing | Knowing how debt works, from student loans to credit cards. | Understanding the interest on your student loan and what your repayments will look like. |

| Protecting | Keeping your money and personal information safe. | Recognising a phishing email that's trying to get your bank details. |

Getting comfortable with these five areas will give you the confidence to handle just about any money situation that comes your way.

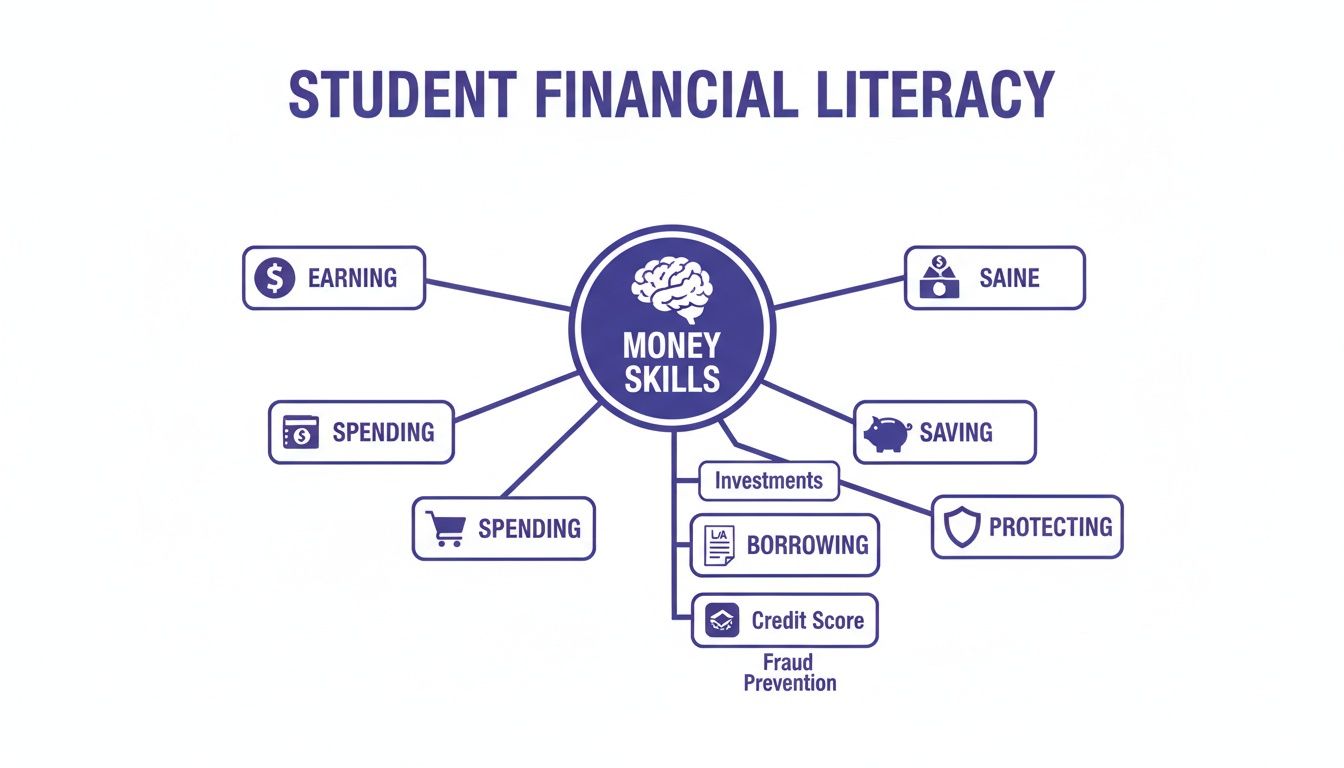

The mind map below gives you a simple visual guide to how these core skills—earning, spending, saving, and borrowing—all connect.

Each branch represents a different but linked skill set. Mastering them is your ticket to building a solid financial foundation that will serve you well long after you've tossed that graduation cap in the air.

Why Financial Literacy Is Your Most Valuable Skill

Let's be real, "financial literacy" sounds like something your dad would lecture you about. But understanding money isn't just about boring spreadsheets or saving receipts; it's about kicking stress to the curb and getting some actual freedom.

Picture two students, Alex and Ben. Alex has a basic handle on budgeting and knows where their money is going. Ben, on the other hand, just spends and hopes for the best, constantly worrying about making rent or having to say 'no' to a night out with mates.

Alex can actually focus on exams because the money stuff is sorted. Ben? He’s constantly distracted by a scary-low bank balance, and it’s tanking his grades and his mental health. This is the whole point of what is financial literacy for students – it’s not about becoming a millionaire overnight, but about getting a grip on your own life.

If you feel this way, you're not alone. It's incredibly common. A national survey found that a massive 74% of U.S. students feel like they need more financial education. Honestly, it's a huge gap, with financial literacy rates for young people sitting under 30%. Many spend hours every week stressing about money, a fact highlighted in this official consumer finance report.

From Surviving to Thriving

Getting your money sorted gives you power. It’s the difference between scraping by and actually building the life you want. When you understand your finances, you can make choices based on your goals, not just what you can afford right now.

That control pays off in some pretty big ways that go way beyond your bank account:

- Less Stress, More Focus: With a solid money plan, you free up so much mental energy for your studies and, you know, actually enjoying life.

- Real Freedom: Financial confidence means you can say 'yes' to cool opportunities—like an unpaid internship or a last-minute weekend trip—without that gut-wrenching anxiety.

- Dodging Debt Traps: Understanding credit and loans helps you sidestep those rookie mistakes that can haunt you for years after you toss that graduation cap.

The real goal of financial literacy isn't to become a Wall Street guru. It's to build a foundation of confidence so you can make intentional choices and slash the anxiety that comes from feeling like you're not in control.

Practical Skills for Everyday Savings

Building these skills starts with small, smart habits. For instance, just knowing how to budget helps you stretch every single dollar. A huge part of that is actively looking for ways to cut costs on daily stuff without living like a hermit.

Making smart spending choices is financial literacy in action. A great, practical way to start is by checking out platforms that offer student discounts for everything from your weekly food shop to new tech. It’s a small step, but it makes your budget go further and reinforces the kind of positive money habits that build real, long-term confidence.

Alright, let's break down the essential skills you need to get a grip on your finances. Knowing what financial literacy is is a great start, but now it’s time to actually put it into practice. Think of this as your quick-start guide to the core money habits that will set you up for life.

Master Your Money with a Student Budget

A budget isn't about restricting yourself—it's about freedom. It’s a game plan that tells your money where to go, so you're not left scratching your head wondering where it all disappeared. For students, keeping it simple is the name of the game.

A great starting point is the 50/30/20 rule. It's a dead-simple way to slice up your income after tax:

- 50% for Needs: This is all the must-have stuff. Think rent, groceries, your phone bill, and transport.

- 30% for Wants: Here’s the fun stuff! Socialising, Netflix, new clothes, that morning coffee—it all fits here.

- 20% for Savings & Debt: This chunk is for your future self. It’s for building an emergency fund, chipping away at debt, or maybe even dipping your toes into investing.

This simple rule helps you live your life now while still looking out for the future, which is exactly what financial literacy for students is all about.

Understand the Basics of Banking

The world of banking can feel a bit full-on, but it's not as scary as it looks. Your main tools are a bank account and the cards that come with it. The first step is picking the right student bank account—hunt for one with no monthly fees and a low (or zero) minimum balance.

You'll mainly deal with two types of cards: debit and credit. Knowing the difference is critical:

- A debit card is linked directly to your bank account. You can only spend the money you actually have. Simple.

- A credit card is basically a short-term loan from a bank. You borrow money for purchases and have to pay it back.

Your debit card is your best mate for daily spending and sticking to that budget. A credit card, if you use it smartly, can be an incredible tool for building your financial future.

Decode Your Credit Score

Think of your credit score as your financial reputation. It's a three-digit number that signals to lenders how trustworthy you are with borrowed money. A good score is your golden ticket for things like renting your first flat, getting a car loan, or even landing certain jobs.

Lenders use this score to decide whether to give you credit and how much interest they'll charge. A higher score says you're a safe bet, which usually means better deals and lower interest payments for you.

Getting a head start on building a positive credit history is one of the smartest things you can do as a student. It opens doors and saves you a tonne of money down the line.

So, how do you build one? It's all about small, consistent habits:

- Pay Your Bills on Time: This is the big one. It's the most important factor, period.

- Keep Your Balances Low: Don't max out your credit card. Using just a small portion of your available credit looks much better.

- Start Small: A student credit card with a tiny limit is the perfect training ground.

Learn About Student Loans and Saving

Let's be real—for most of us, student loans are just part of the deal. The trick is to borrow wisely. With the average student loan debt in the US hitting around $42,673, you absolutely have to understand your loan terms. Get familiar with the interest rates, your repayment options, and when you'll need to start paying it back.

While you're managing debt, you also need to get into the habit of saving. Seriously, even tiny amounts add up, thanks to something called compound interest—it's where your interest starts earning its own interest. Tucking away just $20 a week can grow into a decent safety net for those unexpected expenses. This simple habit is financial literacy in action: making small, smart moves today for a much more secure tomorrow.

Putting Your Financial Knowledge into Practice

Knowing the theory behind financial literacy is one thing, but actually turning that knowledge into real-world habits is where the magic happens. This is the moment where concepts like budgeting and saving stop being boring textbook terms and start becoming powerful tools that actually shape your day-to-day life.

So, let's build a dead-simple, actionable plan to get you started.

The first step? Move from just thinking about a budget to actually making one. Forget the complicated spreadsheets for now. Just grab a notebook or open a simple app and track every single dollar you spend for one week. Seriously, every coffee, every bus ticket. You’ll be shocked at where your money is really going.

This simple act of tracking is the bedrock of smart money management. It gives you a clear, honest picture of where you can make small tweaks that add up to a massive impact over time.

Creating Your First Action Plan

To really get a grip on this stuff, you need to build consistent habits. Think of it like a weekly workout for your wallet—a few simple tasks that keep your money in good shape. This isn't about being restrictive; it's about being aware and taking back control.

Here’s a simple checklist to get you rolling:

- Weekly Bank Account Check-In: Spend five minutes each week just scrolling through your transactions. This keeps you in the loop on your spending habits and helps you spot any weird charges right away.

- Plan Your Big Spends: Got a big night out planned or a pricey textbook to buy? Plan for it. Setting money aside ahead of time stops you from making impulse decisions that can totally wreck your budget.

- Set a Tiny Savings Goal: Challenge yourself to save a specific amount, even if it's just $10. Actually moving that money into a separate savings account makes it feel real and helps build momentum.

A huge part of mastering your money is figuring out how to save effectively. For a deeper dive, this practical guide on how to save money is packed with actionable tips that actually work for students.

To help you stay on track, we've put together a simple weekly checklist. Think of it as your financial fitness routine—a few small reps each week to build serious money muscle over time.

Your Weekly Financial Literacy Checklist

| Task | Why It's Important | Pro-Tip |

|---|---|---|

| Track Daily Spending | Gives you a crystal-clear picture of your cash flow. No more wondering where it all went! | Use a simple notes app on your phone. It's quick, easy, and always with you. |

| Review Bank Statement | Helps you spot sneaky subscriptions, errors, or fraudulent charges before they become big problems. | Set a recurring calendar reminder for every Sunday morning. Make it a habit. |

| Update Your Budget | Keeps your financial plan aligned with your actual spending. A budget is a living document, not a one-time task. | Adjust your spending categories as needed. If you overspent on food, see where you can cut back next week. |

| Plan Next Week's Meals | Food is a massive budget-killer. Planning meals drastically cuts down on expensive takeaway orders. | Cook in batches! Make a big pot of chili or pasta sauce that will last for several meals. |

| Move Money to Savings | This makes saving intentional. "Paying yourself first" ensures you're always building your financial safety net. | Automate it! Set up an automatic transfer for even $5 a week. You won't miss it, but it will add up fast. |

Making this checklist a regular part of your week will transform your relationship with money from passive to proactive.

Making Smart Choices Every Day

Applying financial literacy also means weaving money-saving strategies into your daily routine. Every time you opt for a cheaper coffee, use a discount code, or cook instead of ordering out, you're actively practicing smart spending.

For instance, your student accommodation is probably your single biggest expense. Finding ways to lower that cost can free up a huge chunk of your budget. Our guide to finding student accommodation can help you hunt down more affordable options.

Financial education creates a ripple effect. A study backed by the World Economic Forum found that when students got financial training, not only did their own skills improve, but so did their parents' financial savvy. It just goes to show that building these habits doesn't just help you; it can lift up your whole family.

Ultimately, putting your knowledge into practice just means making conscious spending choices a habit. Instead of buying lunch on campus every day, pack your own a few times a week. Before you click "buy" online, take two minutes to search for a student discount.

These small, deliberate actions are the real building blocks of a secure financial future. This is how you turn abstract ideas into actual cash in your pocket.

Common Money Mistakes Students Make

Getting a handle on your finances isn't just about learning what to do—it's also about knowing what not to do. Let's be real, everyone makes mistakes when they first start managing their own money. Knowing the common pitfalls is like getting a cheat sheet for your future, helping you sidestep the rookie errors many of us fall for.

Think of it this way: by recognizing these traps now, you can build smarter habits from day one.

The Impulse Buy and Credit Card Spiral

This is a classic. It’s so easy to swipe a credit card for small, unplanned purchases. A coffee here, a takeaway there—it doesn't feel like a big deal at the moment, but those little impulse buys snowball fast. Before you know it, you've got a balance that’s impossible to pay off in full, and that's when the interest charges kick in, making everything you bought way more expensive.

This is the dreaded credit card spiral, where tiny debts grow into massive problems.

A simple but seriously effective trick to fight this is the 24-hour rule. If you want something that isn't an absolute necessity, just wait a full day before buying it. That little cooling-off period gives you time to decide if you really need it, killing the impulse and keeping your credit card bill manageable.

The Subscription Black Hole

Monthly subscriptions are another sneaky budget-killer. A streaming service for £9.99, a music app for £10.99, a fitness app for £7.99—each one seems pretty affordable on its own. But when you add them all up, they create a hefty monthly bill that quietly drains your bank account.

So many of us sign up for free trials and then completely forget to cancel, leading to recurring charges for services we barely even use. This "subscription black hole" can easily suck out £30-£50 a month without you even noticing.

The fix is simple: do a 'subscription audit' every few months. Seriously, just go through your bank statement, hunt down every recurring payment, and be ruthless about cancelling anything you don't use regularly. It's one of the quickest ways to free up some cash.

The Student Loan Blind Spot

For most of us, student loans are the first major financial product we ever deal with, yet it's shocking how many students don't fully grasp the terms. A huge mistake is not understanding how interest actually works, especially on unsubsidized loans where it starts piling up from day one. This blind spot means the amount you owe can grow by thousands while you're still in lectures.

To avoid this, treat your student loan like any other massive financial decision. Before signing anything, make sure you know:

- The interest rate: Is it fixed or is it going to change?

- When interest starts accruing: Is it building up while you're still at uni?

- Your repayment options: What plans are available once you graduate?

Another smart move is to cut down on your academic costs right now to minimize future debt. Instead of buying all your textbooks new, you could save a fortune if you sell your old textbooks and put that cash towards next semester's books. This kind of proactive thinking is exactly what financial literacy is all about—making smart choices today to make life easier tomorrow.

Your Financial Future Starts Today

So, what have we learned? Getting your head around money isn't a one-and-done exam you can cram for. It’s more like a journey that kicks off with that first smart decision you make today. You're now armed with the basics: budgeting what you've got coming in, stashing some cash away regularly, and knowing the deal with credit. The goal isn't to be perfect overnight—it's just about making progress.

Every little habit you start building now, no matter how small it feels, is like planting a seed for your future. It all compounds. Taking charge of your finances is honestly one of the most empowering things you can do for yourself. It builds confidence, opens up doors you didn't know existed, and seriously cuts down on the stress that money drama brings.

Remember, being financially literate isn't about saying 'no' to everything fun. It's about giving yourself the freedom to build the future you actually want, one smart choice at a time.

As you start thinking about your career, how much you earn is obviously a huge piece of the puzzle. That’s why mastering job offer negotiation is a non-negotiable skill that can add a staggering amount to your bank account over your lifetime. When you pair smart earning moves with the spending and saving habits you're building right now, you're setting yourself up for some serious long-term wins.

Your financial future doesn’t start when you toss your graduation cap in the air—it starts right now.

Got Questions? We've Got Answers

Stepping into the world of money management can feel like learning a new language. It's totally normal to have a few questions. Here are some quick, no-nonsense answers to the money puzzles students often face.

When Should I Start Building Credit?

Honestly? As soon as you can. For most people, that magic number is 18 years old. Now, this doesn't mean you should go out and apply for a high-limit credit card straight away.

A brilliant first move is to get a secured credit card. Think of it like a credit card with training wheels; you put down a small cash deposit, which then becomes your credit limit. Another solid option is asking a trusted family member to add you as an authorized user on their account. Starting early builds a long, healthy credit history, which is a massive advantage when you eventually want to rent an apartment or get a car loan.

Should I Get a Part-Time Job or Take Out More Loans?

Ah, the classic student dilemma. There's no single right answer here—it really depends on your personal situation. A part-time job is fantastic because it gives you a steady income and real-world experience, meaning you'll rely less on debt. It’s the perfect testing ground for your new budgeting skills.

But, if juggling work is going to tank your grades, a loan might be the smarter play. The golden rule is to only borrow what you absolutely need. Make sure you understand every single detail of the repayment terms before signing anything. It's all about weighing the immediate cash boost against the long-term cost of that debt.

What Is the Easiest Way to Start a Budget?

Forget the complicated spreadsheets and fancy apps for now. The simplest way to start is just to track where your money goes for one month. Seriously, that's it. Use a notes app on your phone or a little notebook and just jot down every purchase. You might be surprised where your cash is actually ending up.

Another brilliant first step is the 'pay yourself first' method. Before you spend a penny on anything else, automatically transfer a small, fixed amount to your savings account each week. This simple habit builds a strong savings muscle without requiring any complex financial gymnastics.

Ready to put your financial skills into action? At Student Wow Deals, we help you stretch your budget further with exclusive discounts on everything from food to tech. Start saving today and make every dollar count. Find your next deal at https://studentwowdeals.com.