Picking the right bank account is one of the first big financial calls you'll make as a student. The NAB Student Account is basically their Classic Banking account, but specially tweaked for full-time students, which means it comes with no monthly account-keeping fees. A huge win when you're trying to save money.

Why Your First University Bank Account Matters

Starting uni is a massive milestone, but it also throws a bunch of new financial responsibilities your way. Your first student bank account is so much more than just a place to stash cash; it’s your financial command centre for your entire university life.

Think about it: it’s where your pay from that part-time café job lands, how you'll pay for ridiculously expensive textbooks, and how you'll manage everyday spending from your morning coffee to late-night study snacks.

Getting a good student account now helps you build smart money habits from the get-go. You'll learn to budget and track your spending without getting stung by annoying fees, which is a game-changer when every dollar counts.

Setting Up Your Financial Command Centre

The right account just makes life easier, letting you focus on what really matters: your studies and actually enjoying the student experience. With one dedicated account, you can handle all those essential payments without the headache.

- Tuition and Fees: Set up direct debits so you don't miss a payment deadline.

- Regular Bills: Automate payments for your phone, internet, and utilities.

- Accommodation Costs: Managing rent is way simpler when your money is all in one spot. If you're still on the hunt for a place, checking out different student accommodation options can help you lock down your budget.

Choosing a fee-free account like NAB's means more of your money actually stays in your pocket. It's a simple move that helps you sidestep the common money traps that trip up a lot of students early on.

This guide is your roadmap to understanding the NAB Student Account, a popular choice for both Aussie and international students. We'll break down how it works and how it can help you get started on solid financial footing from day one.

Alright, so what's the deal with the NAB Classic Banking Student Account?

Think of it as the regular NAB Classic Banking account, but specifically tweaked for the rollercoaster life of a full-time student. It’s your financial home base – a straightforward, everyday transaction account where your money can flow in and out without getting nibbled away by annoying fees.

Its main job is to make your daily spending and money management as painless as possible. When you sign up, NAB sends you a Visa Debit card. This little piece of plastic is your key to buying stuff online, tapping for your morning coffee, and pulling cash out of ATMs. It’s all designed to be super simple, so you can see exactly where your money is going without any confusing bells and whistles.

This is a huge plus when you're just getting the hang of budgeting. The whole point is to dodge those pesky bank charges that can slowly but surely drain your account.

Your Go-To for Everyday Money Stuff

This account is built for your day-to-day, not for stashing away your life savings or playing the stock market. It’s all about handling the basics smoothly.

- Getting Paid: This is where your paycheque from that part-time café job, your scholarship money, or a bit of help from the parents will land.

- Buying the Essentials: Use your card for everything from textbooks and groceries to movie tickets and late-night snacks.

- Sorting Out Bills: You can easily set up automatic payments for your phone bill, streaming services, or gym membership so you don't have to think about it.

This no-fuss setup is perfect for building your confidence with banking before you dive into more complex stuff like credit cards or savings accounts later on.

The real win with the NAB student account is just how simple and cheap it is. By ditching the monthly account-keeping fees, it makes sure every single dollar you have goes towards what you actually need, not the bank's pocket.

Why Go with a Big Bank Like NAB?

Let's be real, banking with one of the big guys like NAB gives you a bit of peace of mind and a massive support network. As one of Australia's "Big Four," NAB is everywhere. They've also put a lot of effort into their digital game, which is a big reason they've been successful at getting younger people on board. You can actually get a sense of NAB's strategy and performance from their investor updates if you're curious.

For you, this means you’ve got a huge network of branches and ATMs you can use, plus a slick and reliable banking app. It’s the best of both worlds: the convenience of modern, tap-and-go banking backed by the stability of a massive financial institution. It’s a pretty solid place to start your money journey.

So, What Are the Big Perks for Students?

Let’s be real, bank jargon can be a total snooze-fest. So, let's translate it into stuff that actually matters for your life. When you get a NAB student account, you're not just getting a piece of plastic and an account number; you're getting tools built to make managing your money less of a headache.

The absolute best part? The one that makes a real difference when you're counting every dollar? No fees.

The core promise here is simple: no monthly account-keeping fees as long as you're a full-time student. This isn't just a small bonus; it's actual money you get to keep for textbooks, groceries, or a much-needed night out.

This one feature means your hard-earned cash isn't getting slowly nibbled away by bank charges every month, which is a common pain with regular accounts. It’s pretty much NAB’s way of saying, "We get it, student life is expensive enough."

Before we dive deeper, here’s a quick rundown of what you’re getting.

NAB Student Account Features at a Glance

This table breaks down the most important features of the NAB Classic Banking account and explains why they’re genuinely useful for students.

| Feature | Benefit for Students |

|---|---|

| No Monthly Account Fees | Keep more of your own money. No surprise charges eating into your budget. |

| NAB Mobile Banking App | Manage everything on the fly – lock your card, check spending, pay mates instantly. |

| Instant Osko Payments | Pay your friends back for pizza in under a minute, no matter which bank they use. |

| Savings Goal Setting | A digital piggy bank to help you save for specific things, like a holiday or a new laptop. |

| Spending & Merchant Insights | See exactly where your money is going (hello, Uber Eats) to help you budget better. |

| Digital Card Security | Instantly lock a lost or stolen card in the app to protect your cash. Panic over. |

These features are designed to give you more control and make banking less of a chore, so you can focus on the important stuff.

Your Whole Bank Fits in Your Pocket

These days, your phone is your life, and your bank should be no different. The NAB app is basically your financial command centre, and it does way more than just show you your balance.

- Pay Your Mates Instantly: Need to split a bill or pay a friend back for concert tickets? You can use Osko to flick them the money in under a minute. Seriously, it's that fast.

- Lost Your Card? No Stress: Misplaced your card after a late-night study session at the library? Instead of freaking out, you can just open the app and instantly lock it. Find it down the side of the couch? Unlock it just as easily.

- See Where Your Money Really Goes: The app automatically sorts your spending into categories. This is a game-changer for figuring out if you’re spending a little too much on coffees or online shopping.

These tools are all about giving you total control and a clear picture of your finances, which is the first step to building solid money habits.

Start Building Smart Money Habits Now

Beyond just tapping your card for daily purchases, this NAB account has features baked in to help you think ahead. It's designed to empower you to be proactive with your money, not just reactive when you’re down to your last few dollars.

Think of the savings goals feature as a digital piggy bank. You can set a target—say, saving up for a trip during the semester break—and the app will visually track your progress. Honestly, seeing that goal bar fill up can be a massive motivator. It turns "I should probably save" into a real, achievable plan.

At the end of the day, these features are about more than just convenience. They're your training wheels for learning how to budget, save, and stay on top of your money. Nailing these skills at uni will set you up for financial success long after you've thrown that graduation cap in the air. This account isn't just for now; it's a practice run for your entire financial future.

How to Apply for Your NAB Student Account

Alright, ready to get this sorted? Applying for a NAB student account is a pretty simple process, designed to get you up and running without a massive headache. This guide will walk you through the whole thing—from checking if you’re eligible to getting your documents in order—so you can get your banking done and get back to your studies.

Think of it like a quick checklist. The main thing you need to tick off is being a full-time tertiary student. That means anyone at uni, TAFE, or another recognised higher education place in Australia. If you’re studying full-time, you're pretty much good to go.

Gathering Your Essential Documents

Before you jump online or head into a branch, it’s a smart move to get your documents ready. It’ll make the whole thing much faster and smoother. You’ll basically need two things: proof of who you are and proof you’re a student.

Here’s a quick list of what to have on hand:

- Proof of Identity: This is just your standard ID. An Australian driver's license, your passport, or a birth certificate will do the trick. It’s always a good idea to have at least two forms of ID ready.

- Proof of Enrolment: This is the big one. You need an official document from your uni or college that confirms you're enrolled full-time for the current academic year. A Confirmation of Enrolment (CoE) or your current student ID card usually works perfectly.

Pro tip: Scan these documents or save them on your computer beforehand. It’ll save you a ton of time, especially if you apply online. It turns what could be a frantic scavenger hunt into a simple file upload.

Once you’ve got your documents, the actual application only takes about 10-15 minutes to knock over online. The NAB website is really clear and guides you through every step, asking for your details and telling you when to upload your files.

A Special Note for International Students

If you're an international student, NAB has a specific process to make things a whole lot easier for you. You can actually kick off your application from your home country up to 12 months before you even arrive in Australia. This is a huge help, as it means you can have your account details sorted before you step on the plane.

Here’s a rough idea of how it works:

- Apply from Overseas: You can fill out the first part of the application online from back home.

- Receive Account Details: NAB will then send you your new account details, which means you can start transferring funds from your home bank account.

- Finalise in Person: When you land in Australia, you’ll just need to pop into a NAB branch with your passport, visa, and Confirmation of Enrolment (CoE) to get the account fully activated and pick up your debit card.

This two-step approach gives you awesome peace of mind, knowing your finances are partially set up before you even arrive.

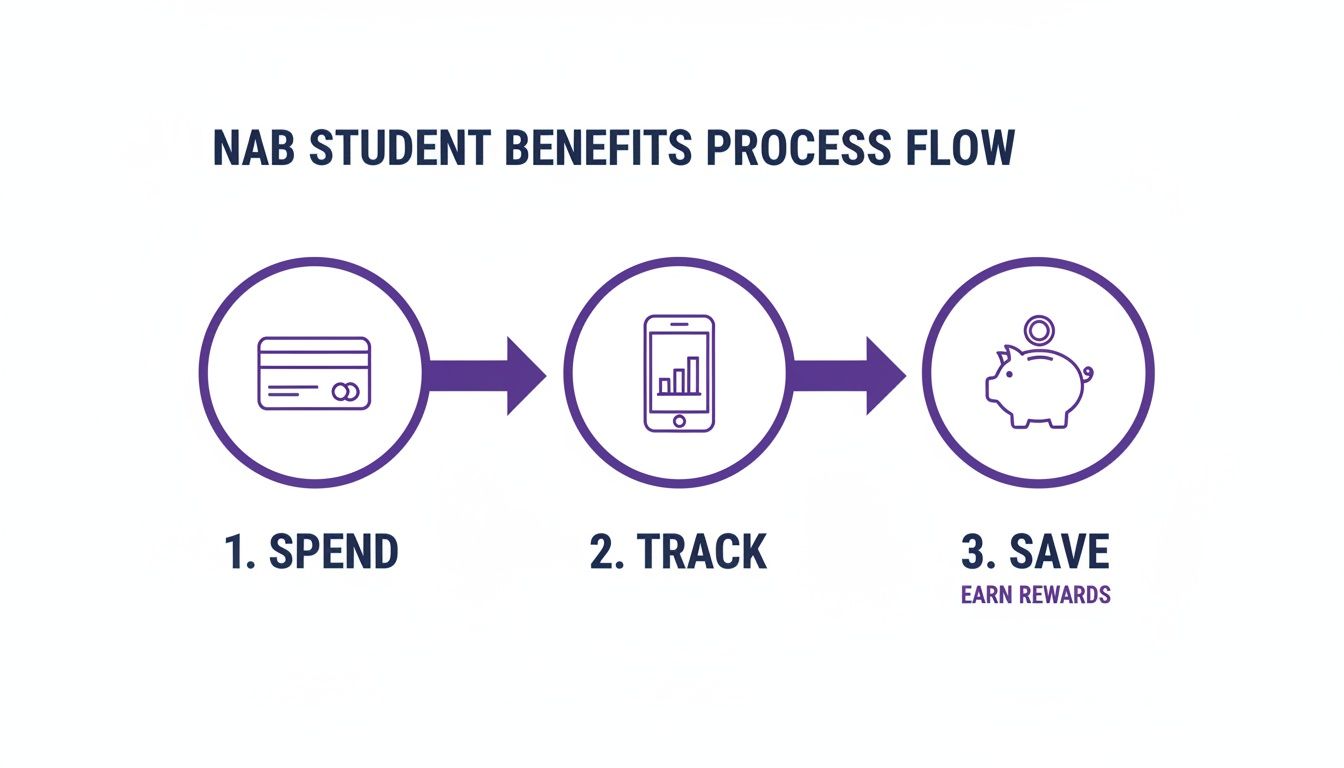

This infographic breaks down how the NAB student account helps you manage your money from day-to-day spending to long-term saving.

The flow shows a simple cycle: use your card for everyday spending, keep an eye on where your money is going with the app, and then use what you learn to build up your savings.

A Financial Guide for International Students in Australia

Moving to Australia to study is the adventure of a lifetime, but let's be real—figuring out a whole new financial system can feel like a massive headache. This guide is built specifically for international students like you, so you can get your money sorted and focus on the good stuff.

First things first: you need a local bank account. Setting up something like the NAB student account is your financial home base. It makes everything easier, from getting money from your family back home to paying for your groceries, all without the stress of constant currency conversions.

Managing Your Money Across Borders

One of the biggest hurdles you'll face is just getting your money here. A NAB account gives you Australian banking details—a BSB and account number—that your family can use to send funds directly to you.

Honestly, this is way better than carrying huge wads of cash or relying on overseas cards that hit you with painful fees. Once the money lands in your account, it's converted to Australian Dollars (AUD), ready for you to use on tuition, rent, and everything else.

Getting your Australian bank account set up is more than just a task to tick off a list. It’s about creating a financial toolkit that helps you settle into your new life, giving you the independence to manage rent, bills, and budgeting with ease.

This kind of financial independence is a game-changer. Plus, you’re actually a huge part of the local economy! Research from NAB shows that international students contributed 0.8 percentage points to Australia’s GDP growth in just one year—that's over half the total growth recorded. You can see the full research on student economic impact if you're curious.

Practical Tips for Settling In

Once your account is up and running, it's time to make your life easier. Setting up automatic payments is an absolute lifesaver for handling those recurring bills without even thinking about it.

- Rent Payments: Schedule direct debits so your landlord is always paid on time. No awkward reminder texts!

- Phone & Internet: Automate your monthly telco bills to stay connected.

- Other Subscriptions: Easily manage everything from your Netflix binge to your gym membership.

Nailing these basics helps you build a solid financial footing from day one. And if you really want to make your money go further, start hunting for local deals. You can find a huge range of student discounts and deals across Australia that can seriously cut down your daily costs.

Squeezing More Value Out Of Your Student Account

Okay, so your NAB student account is all set up. Now it's time to go beyond just having a place for your cash to sit and turn this thing into a proper money-management machine. Don't just see it as a digital wallet; think of it as the launchpad for getting your finances sorted.

A brilliant first move is to link your everyday transaction account to a savings account that actually earns you something, like the NAB iSaver. It's a simple step, but it creates a separate bucket for your savings. Any money you'm not spending on rent or ramen can start earning a bit of interest, helping it grow while still being easy to grab if you need it.

Applying Some Smart Budgeting Rules

The NAB app has some handy built-in features that show you exactly where your money is disappearing to each month. This makes it way easier to apply some classic budgeting tricks. A super popular one is the 50/30/20 rule, which is just a straightforward way to split up your income.

- 50% for Needs: Half of your money goes to the absolute must-haves. This is your rent, bills, groceries, and transport costs.

- 30% for Wants: This is the fun stuff – your lifestyle spending. Think nights out, grabbing food with mates, or putting cash aside for a trip. Finding great student travel discounts can make this part of your budget go a lot further.

- 20% for Savings: The last chunk goes straight into your savings account or towards knocking down any debts you might have.

Of course, having the right account is only half the battle. You’ve still got to be smart with your spending. For some extra ideas on making your cash last longer, this comprehensive money saving guide is packed with useful tips.

It’s no accident that NAB puts this much effort into their student accounts. The bank saw its retail deposits jump by 9%, partly because their slick, fee-free digital apps are a huge hit with younger people. It's a smart way for them to build a relationship with future professionals early on. You can dig into the data in NAB’s research on student banking trends if you're curious.

Last but not least, be paranoid about security. Seriously. Set up payment alerts in the NAB app so you get a ping for every transaction, and keep an eye out for dodgy-looking texts or emails. And it should go without saying, but never, ever share your password or PIN.

When you finally toss that graduation cap in the air, the switch is painless. NAB will usually just roll your account over to a standard Classic Banking account, making sure your money setup transitions smoothly into your post-uni life.

Got Questions About the NAB Student Account? We’ve Got Answers.

Alright, so you’ve got the main details, but what about those little "what if" scenarios that pop into your head? It’s smart to think about the specifics.

Here are some quick, clear answers to the most common questions students have. Think of it as your go-to guide for sorting out any final uncertainties.

What Happens After I Graduate?

Once you've tossed that graduation cap in the air and are no longer a full-time student, your account will usually be switched over to a standard NAB Classic Banking account. Don't worry, this is a super smooth and automatic process.

The biggest change is that the monthly account-keeping fee waiver will come to an end. NAB will give you a heads-up before this happens, explaining the change and your options, so you won't get caught out by a surprise fee.

The best part? The transition is designed to be completely seamless. Your account number and card details stay exactly the same, which means no annoying disruptions to your direct debits or regular payments as you step into the next chapter of your life.

Can I Use My Debit Card Overseas?

Yes, absolutely! Your NAB Visa Debit card is your passport to spending pretty much anywhere in the world that accepts Visa. This is a massive plus for online shopping from international stores or for that well-deserved travel adventure during semester breaks.

You can use it to pay for things directly in stores or pull out cash from ATMs. Just keep in mind that international transaction and currency conversion fees will likely apply. It's also a really good idea to give NAB a heads-up about your travel plans through the app—this helps prevent your card from being flagged for unusual activity while you're away.

Other Key Questions Answered

Here are a few more rapid-fire answers to get you sorted:

- Is there a minimum deposit to open it? Nope! You can open a NAB Student Account with a $0 balance. This makes it incredibly easy to get started, as you don't need to have a chunk of cash ready to go.

- Can I open a joint account with a mate? Generally, these student accounts are designed for individuals. That's because the fee waiver is tied directly to your personal enrolment status. If you need to share expenses with a housemate or partner, your best bet is to chat with NAB about setting up a standard joint account instead.

These answers should cover most of the common hurdles students run into when picking their first proper bank account.

At Student Wow Deals, we're all about making student life more affordable. From exclusive discounts on food and tech to guides that help you manage your money, we've got your back. Check out our latest offers at https://studentwowdeals.com.