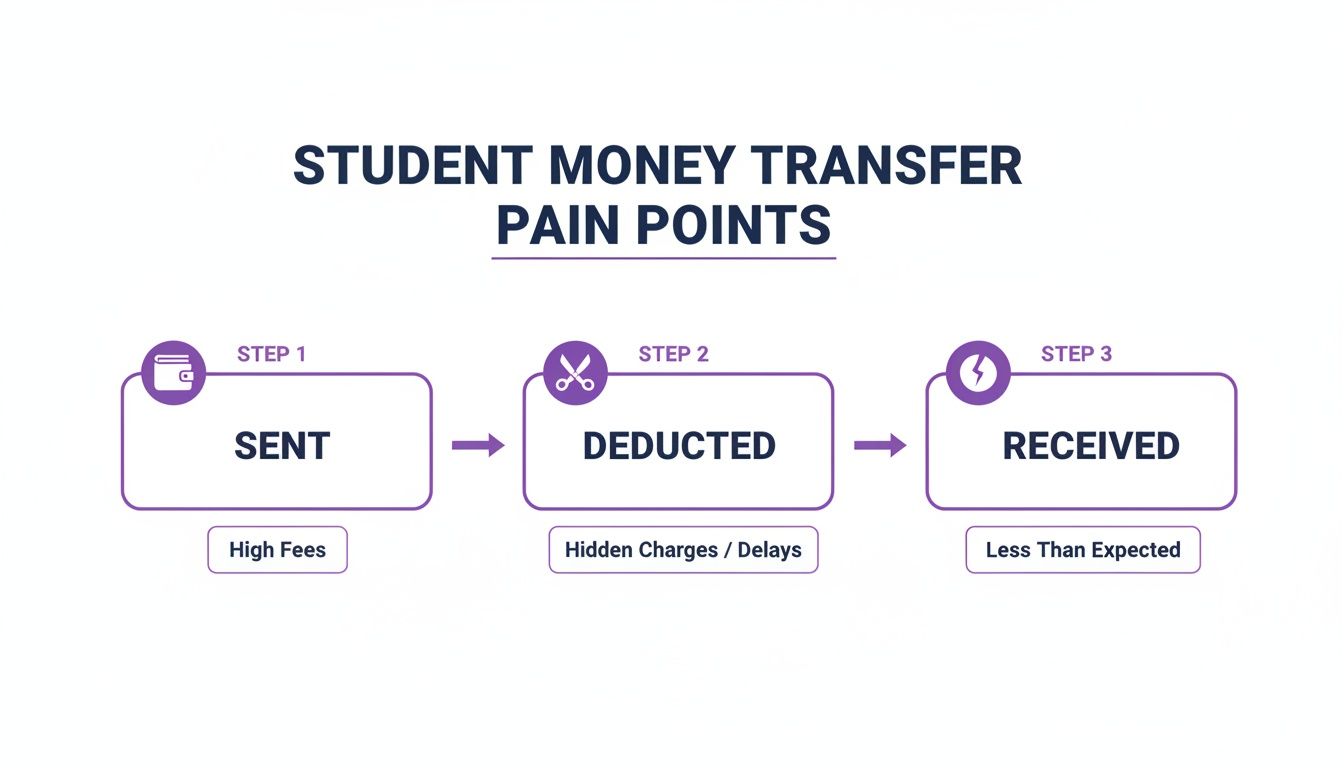

Studying abroad is one of the most incredible experiences you can have, but let's be honest—dealing with old-school banks can be a total nightmare. The hidden international transfer fees and terrible exchange rates are enough to make your head spin.

It's a classic problem: the money your family sends for tuition seems to shrink before it even hits your account. For today's international student, a modern way to manage money across borders isn't just a nice-to-have, it's an absolute necessity.

Why Traditional Banks Just Don't Work for Students

Picture this, because it happens all the time: your family sends you $2,000 for living expenses. By the time that money bounces between a whole web of correspondent banks (each taking their slice of the pie) and gets converted using a rubbish exchange rate, you might only see $1,920 land in your account.

That missing $80 is the price you pay for an outdated system. That’s money that could have gone towards groceries for the month or a couple of essential textbooks.

This isn't some rare, unlucky situation—it’s the reality for a lot of students. Traditional banks often slap on huge wire transfer fees, sometimes as much as $50 per transaction, and then bake in a markup of 3-5% on the exchange rate without telling you. It’s this lack of transparency that creates constant financial stress when you're already trying to settle into a new country.

The Hidden Headaches Beyond the Fees

The problems go way beyond just the obvious charges. Many international students run into roadblocks just trying to open a local bank account. If you compare modern options with the top traditional banks in the Netherlands, for example, you'll see they often demand a mountain of paperwork and proof of residency that a brand-new arrival simply doesn't have.

Some of the most common hurdles include:

- Impossible Documentation: Banks often ask for things like utility bills or residency permits, which are almost impossible to get right after you've moved.

- Painfully Slow Transfers: International wires can take 3-5 business days to clear. That's a long time to wait when your rent or tuition payment is due.

- Frustrating Customer Support: Trying to figure out banking issues in a new country, with processes you're not used to, is a recipe for a massive headache.

And this isn't just a local issue; it's a global one. Higher education enrollment is surging worldwide, and a huge chunk of that growth comes from international students who depend on these cross-border transfers. You can dig into more of this data in a recent UNESCO education report.

For students, every dollar, euro, or pound really counts. Over a three or four-year degree, the combined hit from high fees and bad exchange rates can easily add up to thousands of dollars lost. That's money that was meant for your education, not for padding a bank's profits.

This screenshot of the Wise homepage gets right to the point. It highlights the real exchange rate and a single, clear fee—directly tackling the biggest pain points of traditional banking. It's a preview of a solution that was actually built for how we live and study today, not one stuck in the past.

Getting Your Wise Account Set Up and Verified

First things first, let's get your Wise account up and running. The good news is that it’s surprisingly painless and you can do the whole thing online or from their app. This means you can get it sorted before you even pack your bags.

You’ll kick things off by signing up with your email or linking a social account like Google or Apple. Super simple.

From there, Wise will ask if you need a personal or business account. As a student, you'll want to hit personal. This drops you right into the main dashboard where you can start poking around and see what's what.

The Verification Hurdle: What You’ll Need

Before you can actually move money around, Wise needs to confirm you are who you say you are. This isn’t them being nosy; it’s a standard security step that all financial services have to do to protect your account. For students, it usually just means snapping a couple of photos.

You’ll typically need to upload a clear picture of one of these:

- Your passport: Honestly, this is almost always the quickest and easiest option for international students.

- Your national ID card: As long as it has your photo on it, this works too.

- Your driver's license: Again, just make sure your photo is included.

Next up is proving your address, which can sometimes trip students up if they haven't sorted their housing yet. You can usually use a tenancy agreement for your student digs or an official letter from your university that confirms your enrollment and address. If you're still figuring out where you'll be living, our guide on securing student accommodation has some solid advice on getting this sorted early.

Pro Tip: Use your phone to take really clear, bright photos of your documents. Make sure you get all four corners in the shot with no glare. A blurry or cropped photo is the number one reason for verification delays, and you don’t want that.

This whole process is designed to help you dodge the classic headaches of international money transfers that students have dealt with for years.

Hidden fees and bad exchange rates from traditional banks can seriously eat into the money your family sends you. Wise gets rid of that.

Activating Your Currencies: This is the Game-Changer

Once Wise gives your documents the green light (this can take a few hours or a couple of days), you get to the best part: activating balances in over 40 currencies. This is the key feature for any international student.

Let's say you're from the US studying in Australia. You can open balances for both US Dollars (USD) and Australian Dollars (AUD). The moment you activate that AUD balance, Wise instantly gives you your own Australian bank details—a BSB and an account number.

Now, instead of your parents sending an expensive international wire transfer, they can just make a cheap, local transfer to these details. It’s a massive deal.

This feature is a lifesaver, especially when you think about how many students study abroad. In the United States alone, there are roughly 1.1 million international students, making up about 6 percent of all university enrollments. Efficient and cheap ways to manage money are an absolute must.

By having local bank details in the country where you're studying, you completely sidestep the slow, costly international transfer system. It's how you get your money fast and in full, without any nasty surprises.

Using Your Wise Card for Daily Life Abroad

Okay, your account is verified and loaded up. Now for the fun part: actually using your Wise international account for students to live like a local. This all starts with getting that slick blue debit card in your hands.

Ordering the card is a breeze right from the app. Just pop over to the ‘Card’ tab and follow the instructions. You’ll need to confirm your shipping address—double-check this is somewhere reliable, like your dorm or flat—and pay a small, one-time fee to get it sent out.

When it finally arrives, activation is almost instant. All you have to do is punch the six-digit code from the card into the Wise app, and boom, you’re ready to start spending.

Making Everyday Purchases Seamless

This is where the Wise card really shines. It’s smart enough to figure out currencies for you. Let's say you're studying in Spain and you’ve got a Euro balance that your parents topped up, plus some US dollars from your summer job.

You go to buy a coffee for €3. When you tap your card, Wise is smart enough to pull that money directly from your Euro balance. No conversion, no fees—you’re paying just like a local would. Simple.

Later that day, you need a textbook from a US website that costs $50. Wise sees you don't have enough Euros, so it automatically converts the right amount from your USD balance. It does this using the real exchange rate (the one you see on Google) and charges a tiny, upfront fee. No guesswork, no nasty surprises.

The best part about Wise is that it kills all the mental gymnastics of spending abroad. You can buy groceries, hop on the metro, or book a last-minute weekend trip without worrying about getting stung by hidden bank fees on every single purchase.

Tapping into Mobile Payments and Cash Withdrawals

For maximum convenience, you’ll want to hook your Wise card up to your digital wallet. Adding it to Apple Pay or Google Pay takes about a minute and means you can pay for things with just a tap of your phone or watch. It’s a lifesaver for grabbing a quick coffee on campus or paying for public transport without fumbling for your wallet.

Even in a mostly cashless world, you’ll still need actual cash sometimes. Your Wise card works at ATMs all over the globe, and you get two free withdrawals up to a certain total amount each month (this limit changes depending on where you are, so just check the app).

A few pro tips for using ATMs:

- Withdraw in Chunks: Plan out how much cash you’ll likely need for a week or two. This helps you avoid making lots of small withdrawals that could end up costing you.

- Always Choose Local Currency: This is a big one. If the ATM asks if you want it to handle the currency conversion, always say no. Let Wise do the conversion—you'll get a much, much better rate.

- Know Your Limits: Before you head to the cash machine, give your free withdrawal limit a quick check in the app to steer clear of any extra charges.

Getting these little habits down will save you a surprising amount of cash over a semester. And speaking of savings, you can find some amazing student travel discounts that go hand-in-hand with your Wise card. Combining these deals with Wise's low fees means your travel budget will stretch way further, letting you see more of your new home.

Managing International Money Transfers

This is where your Wise account truly becomes a lifesaver for any student studying abroad. It completely flips the script on moving money across borders, ditching the painfully slow speeds and eye-watering fees that have always been a nightmare with traditional banks.

The best part? How ridiculously simple it makes getting money from home. Instead of your parents navigating a costly international wire transfer, they can now use the local bank details Wise gives you. Studying in France? You get a French IBAN. Over in the US? You get a US routing number.

This tiny detail is a massive deal. It means they can make a simple, often fee-free domestic transfer right into your Wise account. The money lands faster and, most importantly, in full—no mysterious correspondent banks taking a slice along the way.

Receiving Money from Home Like a Local

Let's play this out. Imagine your family needs to send you €1,000 for next month's rent. The old-school way involves them going to their bank, paying a hefty wire fee, and then losing even more money when the bank converts the currency at a garbage exchange rate.

With Wise, the whole thing is transformed:

- You share your local details: Just copy your Euro account details (your IBAN) from the Wise app and ping them over to your parents.

- They make a local transfer: From their own online banking, they send a standard SEPA transfer to your details, just like paying a local bill.

- The money arrives fast: The funds usually hit your Wise account within hours, ready for you to use immediately.

Honestly, this simple change makes a huge difference. Managing tuition and living costs in a foreign currency can be stressful enough without adding wild bank fees into the mix.

Sending Money Back Home or to Other Countries

It’s not just a one-way street, either. If you’re working a part-time job and want to send some cash back home, or maybe you need to pay back a mate in another country, the process is just as cheap and clear.

When you go to send money in the Wise app, there's no guesswork. You punch in the amount, and it immediately shows you the small, fixed fee and the guaranteed mid-market exchange rate. That’s the real, fair rate you see on Google, with zero hidden markups.

Key Takeaway: Wise locks in your exchange rate the moment you start the transfer. This means you know the exact amount your recipient will get, protecting you from any surprise currency swings while the money is in transit.

That kind of transparency is a massive relief when you're on a student budget. As you're planning your finances for different locations, you can find more practical tips in our huge list of country-specific student resources.

The Real Savings: A Look at Fees

So, how much do you actually save? Let’s break it down with a common scenario: sending $2,000 from the US to pay for accommodation in the UK. The difference between Wise and a typical bank is pretty shocking.

| Wise Transfer Fees vs Traditional Bank Wire Fees |

| :— | :— | :— |

| Feature | Wise | Traditional Bank |

| Amount Sent | $2,000 USD | $2,000 USD |

| Upfront Fee | $13.54 | $40 – $50 |$13.54** | ~$80 – $130+ |

| Exchange Rate | Real Mid-Market Rate | Marked-up Rate (adds a hidden 2-4% fee) |

| Hidden Markup Fee | $0 | ~$40 – $80 |

| Total Cost | **

| Amount Received | ~£1,595 GBP | ~£1,520 – £1,540 GBP |

The numbers don’t lie. You could save over $100 on a single transfer. That’s money that’s way better spent on textbooks, groceries, or a well-deserved weekend trip. This is exactly why a modern tool like Wise is essential for student life abroad.

Get Smart With Your Savings

Beyond just moving money around, your Wise account has some seriously clever tools built right in to help you get organised and actually save money. This is what turns it from just another account into a proper financial hub for your life abroad.

Jars: Your Digital Piggy Banks

One of the most useful features is called Jars. Honestly, it's a game-changer for budgeting. Think of them like digital envelopes where you can stash cash away from your main spending balance.

You can set up a Jar for pretty much anything you're saving for, which gives you a super clear picture of where your money's at.

For instance, you could create:

- A "Rent Jar" so you always have that covered. No exceptions.

- A "Weekend Trips Jar" for those spontaneous adventures exploring your new country.

- A "Flight Home Jar" for your next visit to see the family.

By walling this money off, you're way less likely to accidentally blow your rent money on a big night out. It's a simple trick, but it's incredibly good at helping you build solid financial habits without even trying.

Automate Your Money Moves

Another sneaky-good feature is the ability to set up rate alerts. Let's say you've got a big tuition payment to send back home in a few weeks and you want to squeeze every last bit of value out of the exchange rate. Instead of staring at the charts all day, just tell Wise to ping you when the rate hits a number you like.

This means you can pounce when the rate is in your favour for those big transfers, which could literally save you a decent chunk of cash with zero effort. It puts you back in the driver's seat.

The real magic of Wise isn't just the low fees; it's these small, smart features. They're designed to help you make good financial decisions on autopilot, saving you money in the background while you focus on your studies and exploring a new city.

A classic rookie mistake is forgetting to use your local account details for any money people send you. Make sure you give out your specific country details (like your European IBAN or UK sort code). This ensures the payment is treated as a free domestic transfer, saving the sender—and sometimes you—from annoying fees and delays.

It's also a great idea to link your Wise account to a traditional bank in your study country. This creates a seamless bridge between the two, letting you easily move cash for bigger bills or if you ever need to pop into a physical branch. This two-account strategy gives you the best of both worlds: Wise's cheap international power and a local bank's on-the-ground presence.

Got Questions About Wise? We’ve Got Answers.

Jumping into a new way of managing your money can feel a bit weird at first, especially when you’re dealing with different currencies. Don’t worry, it’s pretty straightforward. Here are the answers to the questions we hear most from students using a Wise international account.

Is a Wise Account a Real Bank Account?

Great question. While it does everything you need for daily life—like spending and receiving money—Wise is technically what’s known as an Electronic Money Institution (EMI), not a traditional bank.

This just means they handle your money a bit differently. Your funds are safeguarded by being held in totally separate, protected accounts, away from Wise’s own company funds. So, for things like getting your tuition money, sending cash back home, or just everyday spending, it’s perfect. The main thing to know is that your money isn't covered by government deposit insurance schemes like the FDIC or FSCS. Think of it as the ultimate spending and transfer sidekick to your main bank account back home.

Can I Use My University Address to Open an Account?

Yes, you absolutely can! This is super common for students and exactly what the system is designed for. Using your university dorm or accommodation address is the standard way to verify where you are and get your Wise debit card delivered right to you.

To get your address sorted, you can usually provide one of these:

- Your formal housing contract from the university.

- An official letter from your uni confirming you're enrolled and live at that address.

- A utility bill with your name on it, if you happen to have one.

This flexibility is a lifesaver for students who’ve just landed and don’t have a stack of paperwork yet. It's all about getting you set up and spending like a local, fast.

What Happens If I Lose My Wise Card Abroad?

Losing your wallet overseas is a classic nightmare scenario, but with Wise, you can lock down your money in seconds. Seriously. The very first thing to do is open the Wise app and hit “freeze your card.” That’s it. All transactions are instantly blocked, so nobody can use it.

You can then order a replacement card to be sent directly to your address abroad. And the best part? You're not stranded without cash. You can keep using your digital card for online shopping or add it to Apple Pay or Google Pay to keep making purchases in-store while you wait.

Are There Limits on How Much Money I Can Hold?

Yep, there are limits. Wise has them in place for security and regulatory reasons, and they can change depending on where you live and which currency you're holding. For example, the limits for a US resident holding US Dollars are different from a European resident holding Euros.

For most day-to-day student stuff, these limits are way more than you’ll ever need. But if you’re waiting on a massive transfer—like a whole semester's tuition payment—it’s smart to double-check your specific limits first. You can find all the details right in the Wise app under the "Account Limits" section of your profile.

Ready to manage your money like a local, no matter where you study? Check out the latest student offers and budgeting tips on Student Wow Deals to make your funds go even further. Find out more at https://studentwowdeals.com.