Kicking off your student journey in Australia means making a heap of decisions, and picking the right bank account is a big one right at the start. The Commonwealth Bank Student Account, which is officially called the Student Smart Access account, is a top pick for a reason. It’s designed to make your financial life way simpler.

Think of it as more than just a place to park your cash—it’s a tool built for the chaos of student life, with a massive focus on saving you money.

Why This Account Is a Smart Choice for Students

Let's be real, juggling your finances as a student is a tough gig. You’re trying to cover tuition, textbooks, and living costs, usually on a pretty tight budget. The last thing you need is a bank account that adds to the stress with sneaky fees that chip away at your savings.

This is exactly where the Commonwealth Bank Student Account comes in clutch. It’s a straightforward, cost-effective solution that cuts out the usual banking headaches, letting you focus on what actually matters—your studies and enjoying a bit of freedom.

Designed for the Student Budget

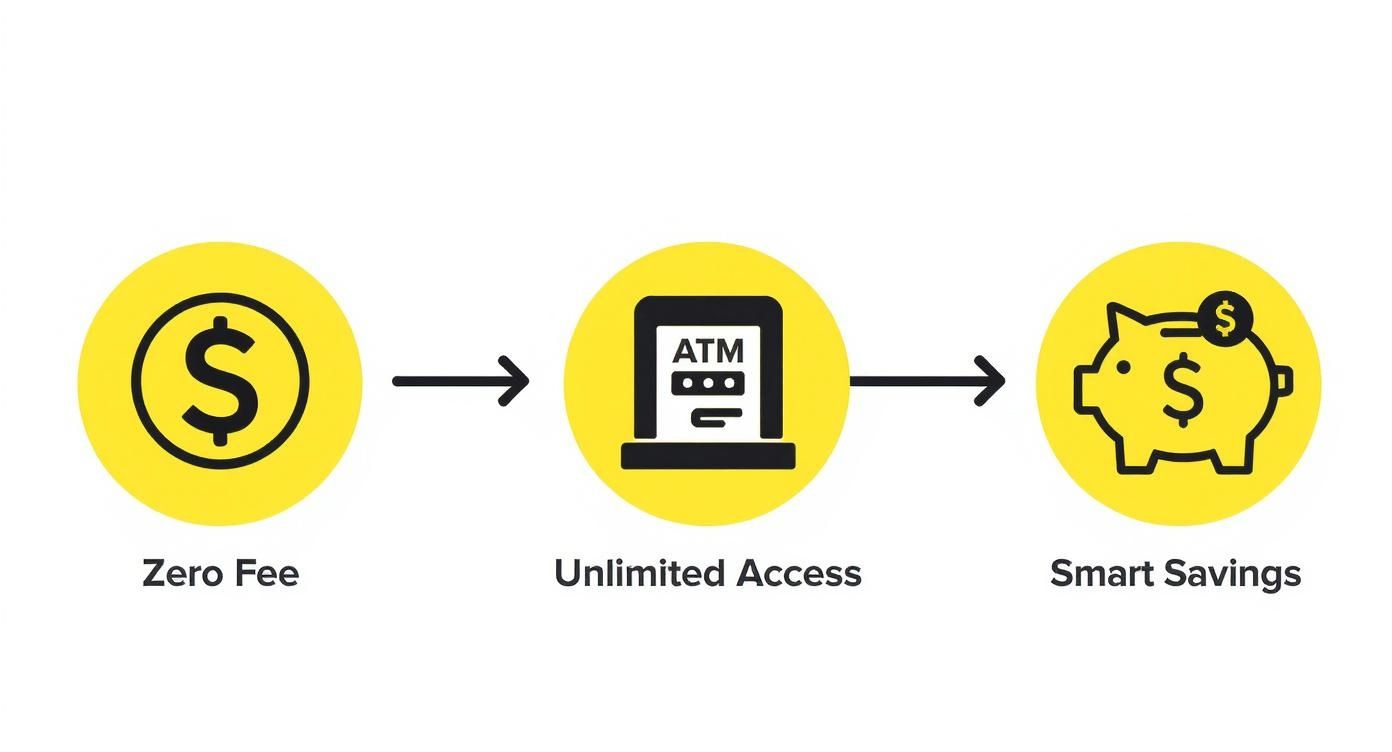

The best part? No fees. Every single dollar counts when you're a student, and not having to pay a monthly account-keeping fee means more cash in your pocket for the important stuff. This isn't just a small perk; it's a game-changer that gets the financial reality of being a student.

This fee-free approach is a massive reason why it's so popular with both local and international students. As long as you're a full-time or part-time student under 30, CBA waives the monthly fee. Simple as that.

More Than Just a Bank Account

Beyond saving you money, this account is a solid tool for getting your finances sorted. When you pair it with the super user-friendly CommBank app, it helps you build good money habits from day one.

Features like spending trackers and savings goals give you a clear look at where your money is going, making it easier to budget. Think of it as a financial co-pilot, helping you manage your daily spending while you save for bigger things. You can find out more in our guides on everything from budgeting to finding the right student accommodation.

The real value of a great student bank account isn’t just in the fees it waives, but in the financial clarity it provides. It should make managing money feel less like a chore and more like an achievable skill.

So, What Are The Key Features and Benefits?

When you’re trying to pick a bank, it’s easy to get lost in the marketing jargon. What really matters is how an account makes your day-to-day life less of a struggle. The Commonwealth Bank student account is genuinely built with this in mind, targeting the real financial headaches that come with being a student. It’s not just a place to park your cash; it’s a tool to help you manage it.

The biggest win here is the fee structure. Or, more accurately, the lack of one. If you're a full-time or part-time student under 30, you'll pay $0 in monthly account-keeping fees. That means more of your money stays right where it belongs—in your pocket. That’s an extra coffee, a couple of chapters of your textbook, or just less stress at the end of the month.

Real-World Access and Tools That Actually Help

Your banking shouldn't dictate your schedule. This account gives you the freedom of unlimited transactions, so you never have to second-guess tapping your card or paying a mate back. Go ahead and split that bill with your housemates or grab groceries as often as you need; you won't get stung with extra costs.

You also get access to one of Australia’s biggest ATM networks. This sounds like a small thing, but not having to hunt for a specific ATM or cop a fee from another bank is a lifesaver when you're in a hurry.

Honestly, the real power of this account is its digital side. The CommBank app is more than just a balance checker—it turns your phone into a financial command centre, showing you exactly where your money goes and helping you save smarter.

The app is packed with features that are actually useful for building good money habits.

Let's quickly break down the most important features and what they mean for you as a student.

Commonwealth Bank Student Account Features at a Glance

| Feature | Benefit for Students |

|---|---|

| No Monthly Fees | Keep more of your own money. No hidden costs for students under 30. |

| Unlimited Transactions | Pay for things as often as you need without worrying about extra charges. |

| Large ATM Network | Easily access your cash for free at thousands of locations across Australia. |

| CommBank App | A powerful app that helps you track spending, set savings goals, and predict bills. |

| Cardless Cash | Withdraw cash from an ATM using just your phone—perfect for when you forget your wallet. |

| Security Features | Lock, block, or limit your card instantly through the app for peace of mind. |

These features work together to create a seriously helpful banking experience, taking a lot of the guesswork out of managing your money while you study.

The app comes with a few standout tools designed to give you financial confidence:

- Spend Tracker: This is a game-changer. It automatically sorts your purchases into categories, so you can see at a glance if you're spending way too much on Uber Eats. It’s the reality check we all need sometimes.

- Goal Tracker: Got your eye on a new laptop or a weekend getaway? This feature lets you set savings goals and visually track your progress. It’s surprisingly motivating to see that goal bar fill up.

- Bill Sense: This one is brilliant for avoiding those "Oh no!" moments. It scans your transaction history to predict upcoming bills, helping you make sure you’ve always got enough cash set aside.

Think of these tools as having a mini financial advisor in your pocket. They don't just throw numbers at you; they give you insights you can actually use. The money you save can even fund a bigger adventure. Why not get inspired by checking out our guide on student travel deals?

When you combine the no-fee structure, easy access, and genuinely smart digital tools, the Commonwealth Bank student account becomes a strong ally for getting through uni without financial drama.

A Step-by-Step Guide to Your Application

Opening a new bank account can feel like you're about to climb a mountain of paperwork. Luckily, applying for the Commonwealth Bank Student Account is surprisingly chill. It’s a pretty quick and easy process, whether you're a local Aussie student or sorting things out from overseas.

First thing's first, let's make sure you're eligible. To get all the fee-free goodness, you need to be a full-time or part-time student studying here in Australia. You’ll have to flash some proof of enrolment, like your student ID card or an official letter from your uni or TAFE. Think of this as the magic key that unlocks the account's best perks, like ditching those monthly account fees.

Getting Your Docs Ready

Having all your documents organised beforehand will make the application process a total breeze. It’s like prepping your ingredients before you start cooking – no last-minute panic or scrambling around.

Here’s what you’ll generally need to have on hand:

- Proof of Identity: You'll usually need 100 points of ID. Things like your passport, driver's licence, or birth certificate are perfect for this.

- Proof of Enrolment: Your student ID or a letter of offer from your university or TAFE is a must-have.

- Tax File Number (TFN): This one's optional, but it's a good idea to provide it. If you don't, the government will withhold tax from any interest you earn on your savings.

Once you're all set up, you get access to some seriously useful benefits.

As you can see, it's all about making banking more accessible so you can focus on smarter savings.

How to Apply Online

For most students, applying online is definitely the way to go. It’s fast, and the Commonwealth Bank website walks you through every single step.

You'll start by entering your personal details, uploading your documents, and verifying your identity. Honestly, the whole thing can often be done and dusted in under 15 minutes. Once you hit submit, you should get a confirmation and your new account details pretty quickly.

Pro Tip: If you're an international student, you can get a massive head start. You can actually open your Commonwealth Bank student account up to 14 days before you even land in Australia. This is a game-changer because you can transfer money over ahead of time, so it's ready and waiting for you.

When you arrive, all you need to do is pop into a local branch with your passport and enrolment proof to get fully verified. After that, you'll get your debit card and full access to your funds. It’s a simple step that makes settling into a new country a whole lot less stressful.

How to Avoid Unexpected Fees and Charges

The biggest drawcard for the Commonwealth Bank student account is the $0 monthly fee. For any student juggling textbooks, rent, and a two-minute noodle diet, that’s a huge win. But like with any bank account, a few other charges can sneak up on you if you’re not paying attention.

Think of it like your phone plan. The monthly subscription is sorted, but you can still get stung for extra data if you binge-watch a whole new season on the bus. This account is pretty similar—your everyday banking is free, but certain actions can trigger a fee.

The good news? These fees are almost completely avoidable. A little bit of savvy is all it takes to make sure your money stays exactly where it should be: in your account.

Let's break down the common culprits.

Watch Out for These Common Charges

The fees that most often catch students out are tied to specific situations that fall outside your normal, day-to-day account use. Knowing what they are is the first step to dodging them completely.

Here are the main ones to keep on your radar:

- Non-Commonwealth Bank ATM Fees: You get free access to thousands of CommBank ATMs, which is great. But if you use an ATM from another bank, they'll likely charge you a fee for the convenience. It's the other bank's fee, not CommBank's, but it still comes out of your balance.

- International Transfer Fees: Need to send some money back home to family or friends overseas? That's not free. CommBank charges for international money transfers (IMTs), and the cost can change depending on the currency and where you're sending it.

- Overdrawing Your Account: This is a classic. If you spend more money than you actually have, your account goes into a negative balance, or "overdrawn." This can trigger an overdraw fee, which is basically a penalty for dipping into the red.

This isn't about making you paranoid about fees. It's about empowering you to be smarter with your cash. A quick check before you tap or transfer can easily save you from a needless expense down the road.

Smart Habits to Keep Your Account Fee-Free

Dodging these fees is all about building a few simple habits. For starters, make a point of only using CommBank ATMs. The CommBank app has a super handy ATM locator to help you find the nearest one, so you're never caught out needing cash.

When it comes to sending money overseas, it pays to plan ahead. Compare the fees and exchange rates with other services to see if you can get a better deal.

And for avoiding overdraft fees, the solution is simple but crucial: keep a close eye on your balance. The CommBank app is your best friend here. Use its real-time alerts and the Spend Tracker tool to always know where your funds are at. It’s the easiest way to stop yourself from spending money you don't have.

By picking up these small habits, you can confidently manage your Commonwealth Bank student account without any nasty surprises.

Comparing Your Student Banking Options in Australia

Picking a bank can feel a bit like picking a footy team—once you're in, you tend to stick around for the long haul. While the Commonwealth Bank student account is definitely a top contender, it’s always a good idea to scout the competition before you commit.

Australia's "Big Four" banks—that’s CommBank, NAB, Westpac, and ANZ—all roll out the red carpet for students with their own special accounts, and each one brings something different to the table. Knowing what's out there helps you make a choice that actually fits your life, not just one that everyone else is making.

A Head-to-Head Comparison

So, let's break down the main players. It’s no secret that Commonwealth Bank is a giant. As Australia’s largest retail bank, it holds a massive market share of around 14.3%. That scale translates into a huge network of 741 branches and 1,956 ATMs, which means you’re almost always near one. That kind of accessibility is a huge plus.

But bigger isn't always better for everyone. The other banks have some seriously good offers that might be the perfect match for what you need.

It's also worth getting your head around the basic differences between credit unions and banks. While we’re focusing on the big guys here, sometimes smaller, member-owned institutions can offer a more personal touch.

To make things easier, we've put together a quick comparison of what the 'Big Four' are offering students right now.

Student Bank Account Comparison: Major Australian Banks

Here’s a side-by-side look at the student accounts from Australia's major banks, so you can see how they stack up at a glance.

| Bank | Account Name | Monthly Fee | Key Features | Best For |

|---|---|---|---|---|

| Commonwealth Bank | Student Smart Access | $0 for students | Massive ATM/branch network, top-tier app with budgeting tools, Cardless Cash. | Students who want a powerful app and easy access to cash and branches everywhere. |

| NAB | NAB Classic Banking | $0 for everyone | No monthly account fees for any customer, ever. Simple and straightforward banking. | Anyone who wants a no-fuss, fee-free account without student eligibility hoops. |

| Westpac | Westpac Choice | $0 for students | Large ATM network (shared with St.George, Bank of Melbourne, BankSA), good savings features. | Students looking for solid features and broad ATM access beyond just one bank. |

| ANZ | ANZ Student Access Advantage | $0 for students | A simple, no-frills account that covers all the essentials without any complexity. | Students who just need a basic, reliable bank account to get the job done. |

This table gives you a solid starting point, but remember to dig a little deeper into the one that catches your eye to make sure it ticks all your boxes.

The best choice isn't always the most popular one. It's the one that makes your money life simpler. Think about your day-to-day habits. Are you constantly pulling out cash, or do you live on your phone? The answer will point you to your perfect match.

When all is said and done, the Commonwealth Bank student account really shines with its mix of zero fees for students, a massive physical footprint, and a mobile app packed with tools to help you manage your money. While the others offer great fee-free accounts, CommBank’s digital experience gives it an edge for students trying to build good money habits from the get-go.

And hey, while you’re sorting out your finances, don't forget to check out the huge range of exclusive offers over at Student Wow Deals to make your student life even better.

Common Questions About Student Banking

Navigating student banking for the first time can throw up a bunch of questions. Whether you’re just getting started or getting ready to toss that graduation cap in the air, it’s smart to know exactly how your account works now—and what’s coming next.

We’ve pulled together the most common questions students have about the Commonwealth Bank student account. Here are the straightforward answers you need to manage your money like a pro.

What Happens to My Student Account After I Graduate?

This is the big one on every final-year student's mind. Once you've graduated and are no longer a full-time student, CommBank will typically switch your Student Smart Access account over to their standard Everyday Account Smart Access.

The biggest change? The monthly fee waiver. Instead of being free because you're a student, you'll need to meet new criteria, like depositing at least $2,000 into the account each calendar month to keep it fee-free. Don't stress, this doesn't happen the day after your last exam. Commonwealth Bank will give you a heads-up before they make the switch.

Keep an eye on your emails and app notifications as you get closer to finishing your course. It’s the perfect prompt to check in with the bank and figure out which account will be the best fit for your new, post-uni life.

Can International Students Apply Before Arriving?

Absolutely, and it’s a huge plus for international students. Commonwealth Bank has a process that lets you open an account up to 14 days before you even land in Australia. This is a game-changer for getting settled smoothly.

By setting up your account early, you can transfer money from home so it’s ready and waiting for you. It’s one less thing to worry about, freeing you up to focus on finding your way around campus and diving into your studies.

Once you’re here, you just have one final step to complete:

- Pop into a Branch: Find your nearest Commonwealth Bank branch.

- Verify Your ID: You’ll need to show your documents, like your passport and your Confirmation of Enrolment (CoE).

- Get Full Access: Once you're verified, you’ll get your debit card and be able to access all your money and account features. Easy as that.

Are There Limits on CommBank Rewards Cashback?

CommBank Rewards is a brilliant perk, giving you cashback when you shop at certain stores. But to really make the most of it, you need to know how it works. These deals aren't automatic—you have to activate them in the CommBank app before you pay.

Every offer has its own rules. Some might require you to spend a minimum amount, while others might cap how much cashback you can earn from that specific deal or in a month. The best habit to get into is tapping on an offer in the app to read the fine print. It only takes a second and makes sure you don’t miss out on the rewards.

What Budgeting Tools Does the CommBank App Offer?

The CommBank app is so much more than just a way to check your balance. It's loaded with tools designed to help you build good money habits from day one.

Here are a few of the most useful features for students:

- Spend Tracker: This tool is a lifesaver. It automatically categorises your spending into buckets like 'Groceries', 'Transport', and 'Eating Out'. Seeing exactly where your cash is going makes it way easier to spot where you can cut back.

- Goal Tracker: Perfect for saving up for something big, like a new laptop, a flight home, or a weekend road trip. You can name your goal, set a target, and watch your savings grow.

- Bill Sense: This clever feature acts like a financial fortune-teller. It predicts your upcoming bills and subscriptions based on your past payments, giving you a heads-up so you can make sure you’ve got the funds ready.

Beyond your everyday banking, getting a handle on your bigger financial picture is key, especially if you're thinking about loans. It's never too early to look into student loan payoff strategies to set yourself up for success after uni.

Ready to make your student life more affordable and fun? Join Student Wow Deals for free and get access to hundreds of exclusive discounts on food, fashion, tech, and more. We’re here to help you save money every step of the way. Sign up now and start saving!